CASE STUDY INFORMATION Helga Hemp owns Born Again

Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions.. Multiply the amount on line 6 by the federal tax rate (R) based on Chart 1: $57,650.84 × 0.205: $11,818.42 (8) Minus the federal constant (K) based on the annual taxable income on line 6 (go to Chart 1)

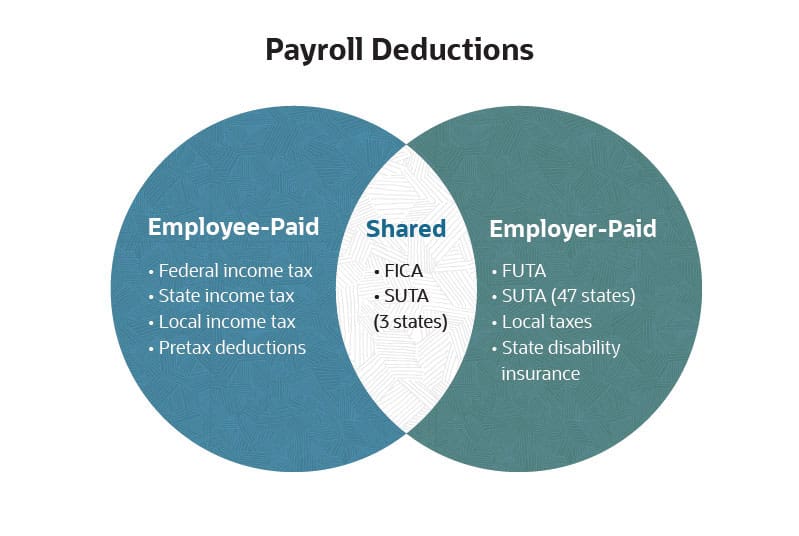

Infographic What's In Payroll Taxes Small Biz Dad

In Victoria the thresholds are $700,000 of taxable wages annually or $58,333 monthly. Where the thresholds are exceeded then payroll tax becomes payable at a rate of 4.85%. Regional employers may be able to access a decreased rate of 1.2125%. A full comparison of rates and thresholds for 2022/2023 is provided at the bottom of this article.

How Are Payroll Taxes Different From Personal Taxes? finansdirekt24.se

Payroll tax eligibility in Victoria is a crucial aspect for businesses navigating the state's tax landscape. Understanding your payroll tax obligations can be tricky.. As of 1 July 2023, the payroll tax rate for Metropolitan employers is 4.85% and the payroll tax rate for Regional employers is 1.2125%.

payrolltaxdistribution NCPSSM

Advanced Features of the Croatia Income Tax Calculator. Tax Assessment Year The tax assessment year is defaulted to 2023, you can change the tax year as required to calculate your salary after tax for a specific year. Your Age You age is used to calculate specific age related tax credits and allowances in Croatia.

What is a payroll tax? Payroll tax definition, types, and employer obligations QuickBooks

The payroll tax rate in Victoria has been set at 4.85 per cent since 2014-15. In the 2017-18 financial year, a lower payroll tax rate of 3.65 per cent was introduced for regional businesses. The rate was reduced further to 2.425 per cent from 1 July 2018. This payroll tax cut created a natural experiment which we exploit using difference-in.

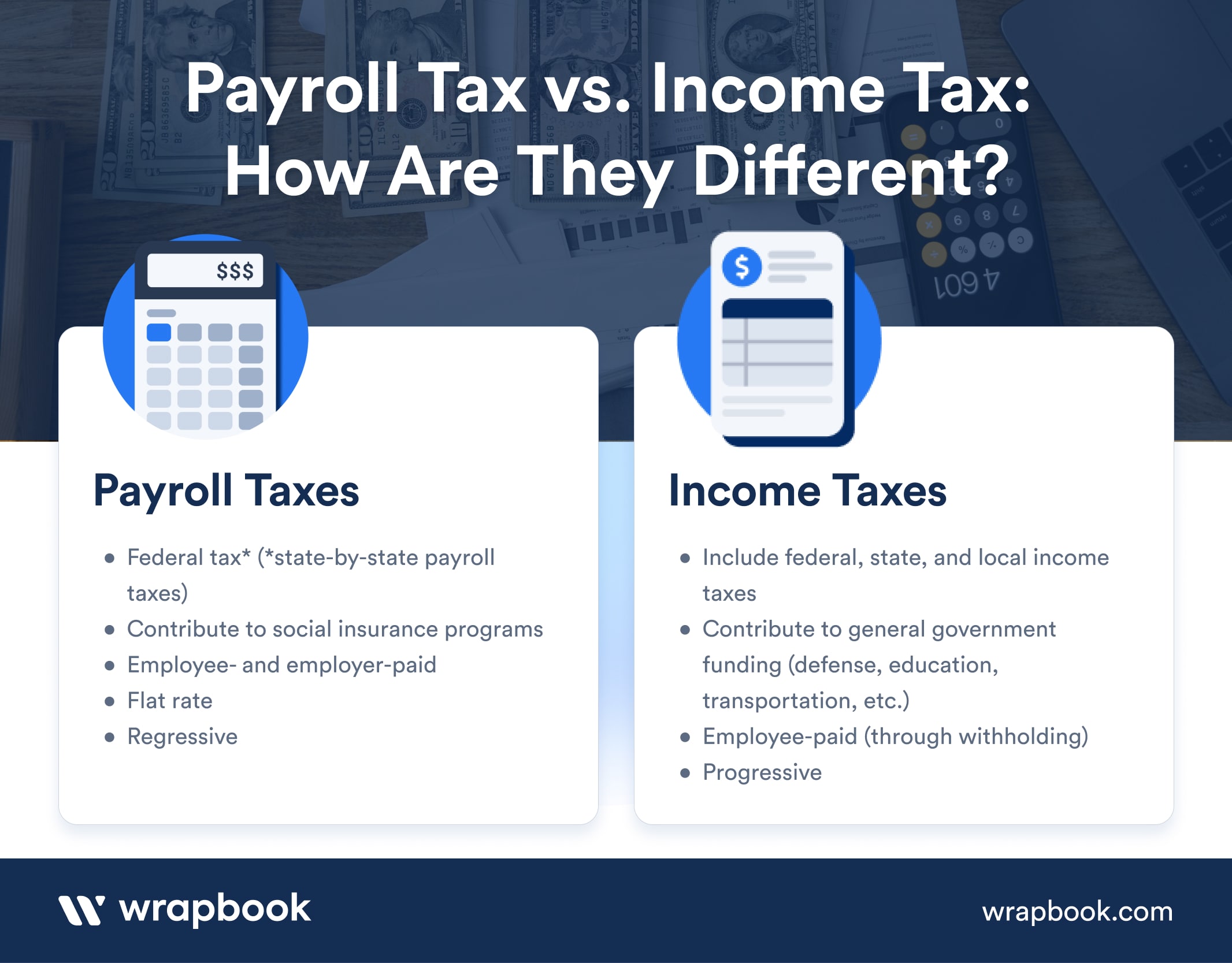

What are Payroll Taxes? An Employer's Guide Wrapbook

In Victoria, the payroll tax rate is 4.85%. However, regional employers who pay at least 85% of payroll to regional employees have a lower payroll tax rate of 2.425%. The payroll tax threshold in Victoria is $650,000 for the tax year from 1 July 2019 to 30 June 2020. Payroll tax in Victoria is lodged on the State Revenue Office website.

Which of the Following Is Not an Employer Payroll Cost IrvinhasThornton

A temporary payroll tax surcharge commenced from 1 July 2023. The surcharge has been introduced to address Victoria's COVID-19 debt and expires after 10 years. You must pay the surcharge if you pay Victorian taxable wages and your Australian wages exceed the first annual threshold of $10 million, with a first monthly threshold of $833,333.

What are Payroll Taxes? An Employer's Guide Wrapbook

The payroll tax rate in Western Australia is now 5.5% across the board for all employers or group employers with annual taxable wages in Australia of more than $1 million. Tax Year. Threshold. Rate. From 1 July 2023. $1 million - $7.5 million. 5.5%. From 1 July 2023. $7.5 million and above.

What is payroll tax also called? YouTube

Property tax is levied on the assessed value of properties in Victoria, BC. The tax revenue is used to fund local services and infrastructure. Property owners are responsible for paying property tax annually, and the amount is determined by the assessed value of the property and the municipal tax rate. 3.3 Sales Tax

Victoria Payroll Tax Update September 2021 Tobin Partners

As part of measures to address he COVID debt, a temporary payroll tax surcharge will apply from 1 July 2023 for 10 years until 2033. For businesses with taxable wages in Victoria exceeding $10m the surcharge will be 0.5%. Businesses with a national payroll over $100m will be subject to an additional 0.5%. To alleviate the payroll tax burden on.

Figure payroll taxes calculator

As well, the study found that those top income earning families pay 53.1 per cent of total taxes. Similar data was also compiled by Statistics Canada on those who pay higher income taxes. For.

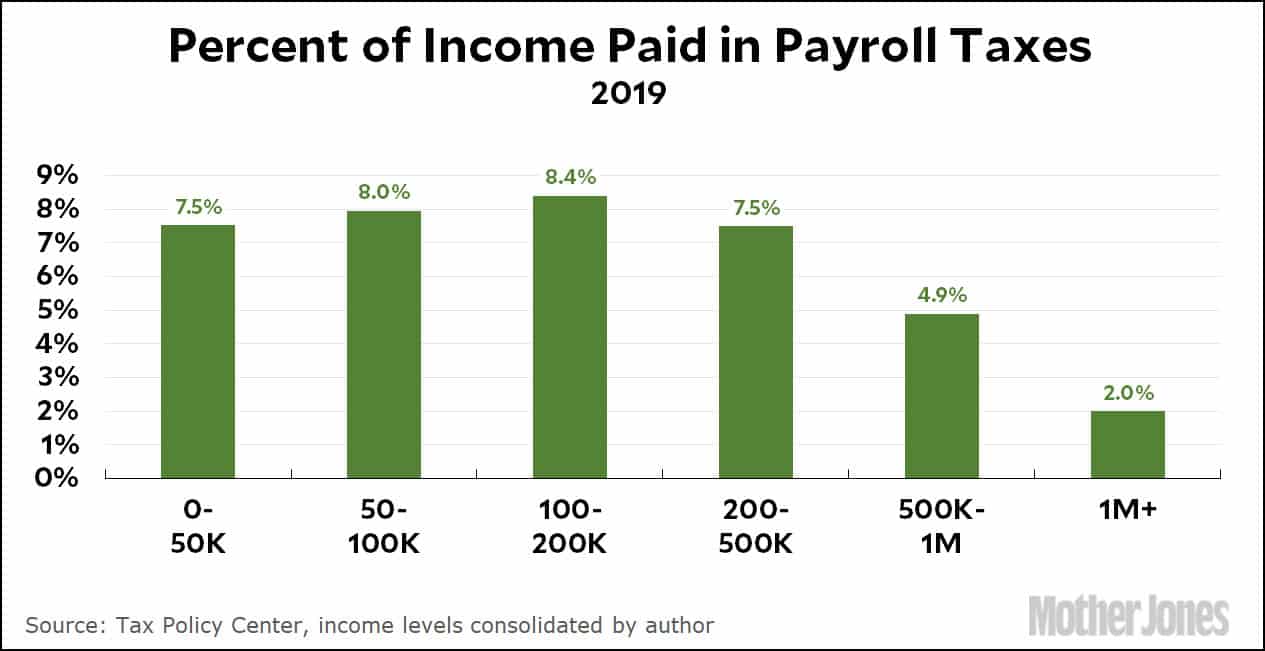

Payroll Tax Rates Tax Policy Center

The tax is paid by employers based on the total remuneration (salary and benefits) paid to all employees, at a standard rate of 14% (though, under certain circumstances, can be as low as 4.75%). Employers are allowed to deduct a small percentage of an employee's pay (around 4%). [7] Another tax, social insurance, is withheld by the employer.

Payroll Taxes by State Infogram

It's levied as a surtax to the individual's personal income tax liability. Croatia has been a member of the European Union since 1 July 2013. On 12 July 2022, the Council of the European Union approved the accession of Croatia to the euro area on 1 January 2023 and determined the conversion rate for the Croatian kuna as HRK 7.53450 per Euro.

How to Pay Payroll Taxes A Stepbystep Guide

The payroll tax rate in Victoria is 4.85%, except for regional Victorian employers. For regional Victorian employers, the rate is 1.2125%. In addition, there's a mental health and wellbeing surcharge of 0.5% and a temporary payroll tax surcharge of 0.5% applicable to employers with more than $10 million in Australian Taxable Wages. If your.

Payroll Tax What It Is, How to Calculate It NetSuite

The following payroll tax changes have been annouced: As part of its COVID Debt Repayment Plan, from 1 July 2023, a levy on payroll will apply to businesses with annual Australia-wide taxable wages above $10m. From 1 July 2024, the payroll tax-free threshold will increase from $700 000 to $900 000, and subsequently increase to $1m from 1 July 2025.

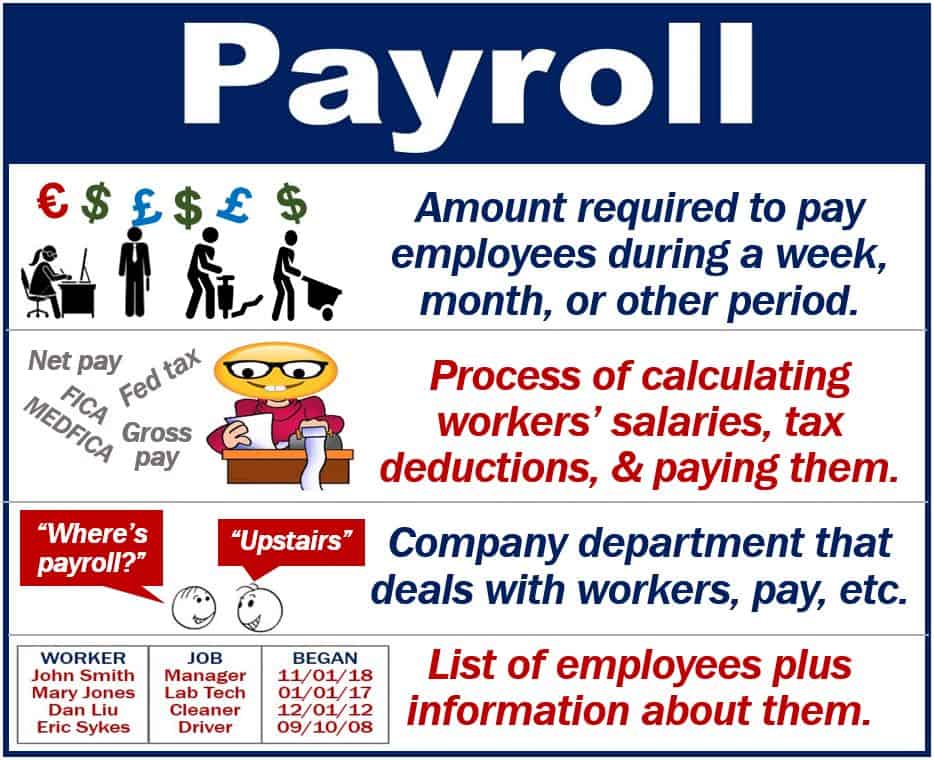

What is payroll? Definition and examples Market Business News

The general payroll tax rate in Victoria is currently (since 1 July 2014) is 4.85%, eligible regional employers 2.425% progressively reducing to 1.2125% by 2022-23. Regional employers: From 1 July 2017 a payroll tax rate of 3.65% (2.425% from 1 July 2018) is for businesses with a payroll of 85% regional employees.

- Have U Ever Seen The Rain Rod Stewart

- Macbook Air 13 Inch Case Australia

- Melbourne Flower Show 2023 Dates

- Where To Watch The Gypsy Rose Movie

- Stable Diffusion Image To Image

- Dan Ige Vs Nate Landwehr

- Sydney Opera House On Fire

- Athol Bay Sydney Harbour Map

- Uv Doux Sunscreen Spf 50 In Australia

- Difference Between Illness And Disease