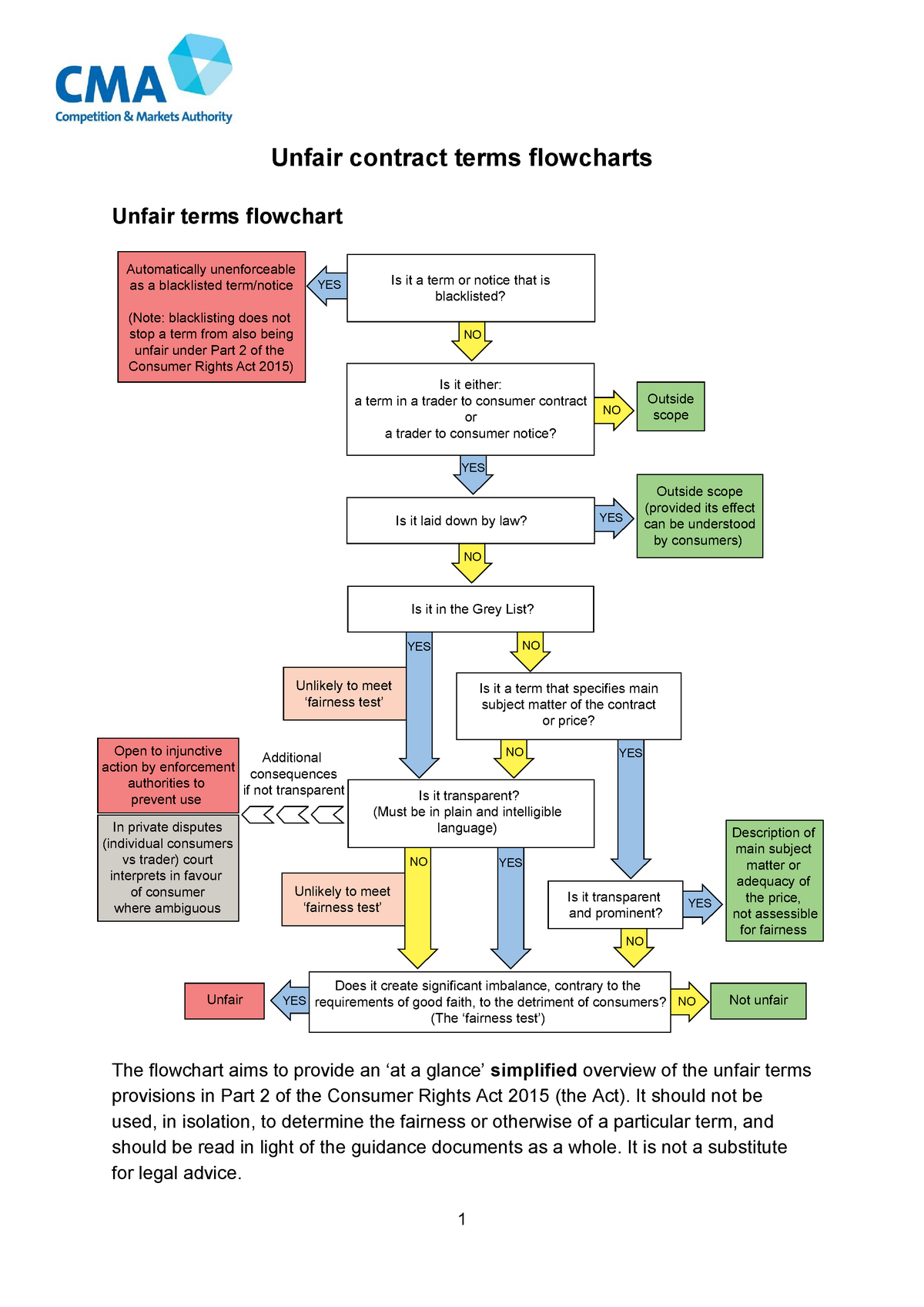

Unfair terms flowchart CONTRACT Unfair contract terms flowcharts Unfair terms StuDocu

Examples of potentially unfair terms include those that: charge the consumer a large sum of money or an amount that goes beyond what would be considered a reasonable pre-estimate of loss incurred by the firm, if a consumer doesn't fulfil their obligations under the contract or cancels the contract. require a consumer to fulfil all their.

[Webinar] The New Unfair Contracts Terms What it means for your business Results Legal

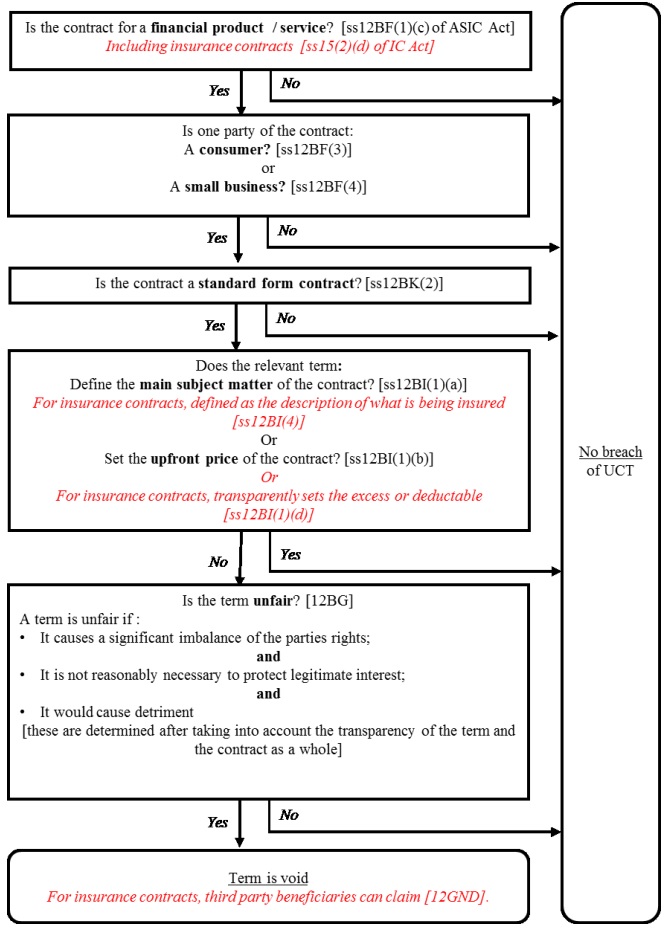

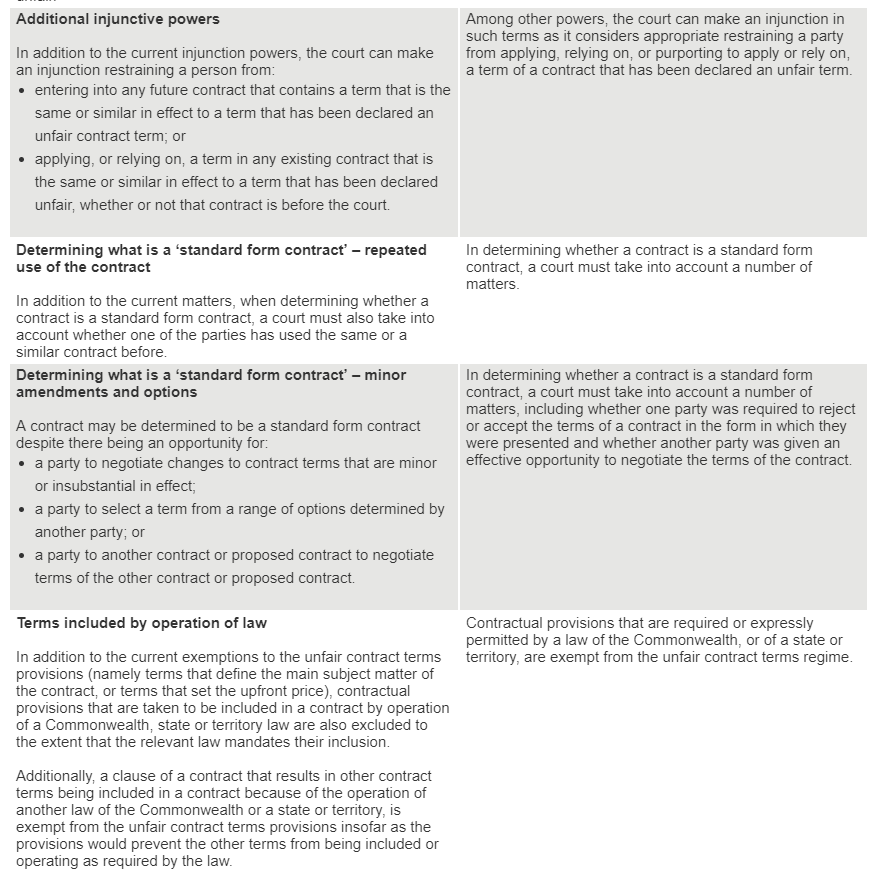

The unfair contract terms law also applies to small businesses: see Information Sheet 211 Unfair contract term protections for small businesses . Standard form contract. The unfair contract terms law covers standard form consumer contracts for financial products or the supply, or possible supply, of financial services.

The Financial Services Royal Commission’s for Unfair Terms in Insurance Contracts

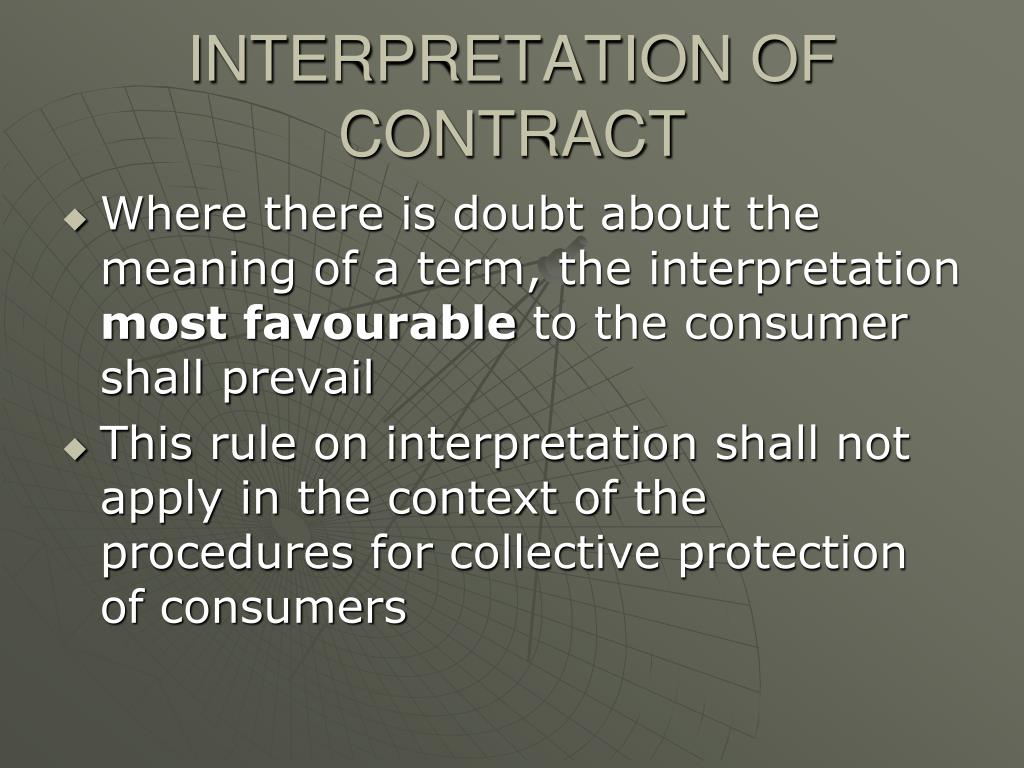

The Unfair Contract Terms Directive (93/13/EEC) protects consumers against unfair standard contract terms imposed by traders. It applies to all kinds of contracts on the purchase of goods and services, for instance online or off-line-purchases of consumer goods, gym subscriptions or contracts on financial services, such as loans..

PPT CONTRACT LAW PowerPoint Presentation, free download ID1901730

Unfair contract terms refer to provisions in contracts that create an imbalance of rights and obligations between the parties involved. These terms can exploit the weaker party and restrict their legal rights, often leaving them at a disadvantage. Recognizing and identifying unfair contract terms is essential for anyone entering into a.

Unfair Contract terms in Franchising

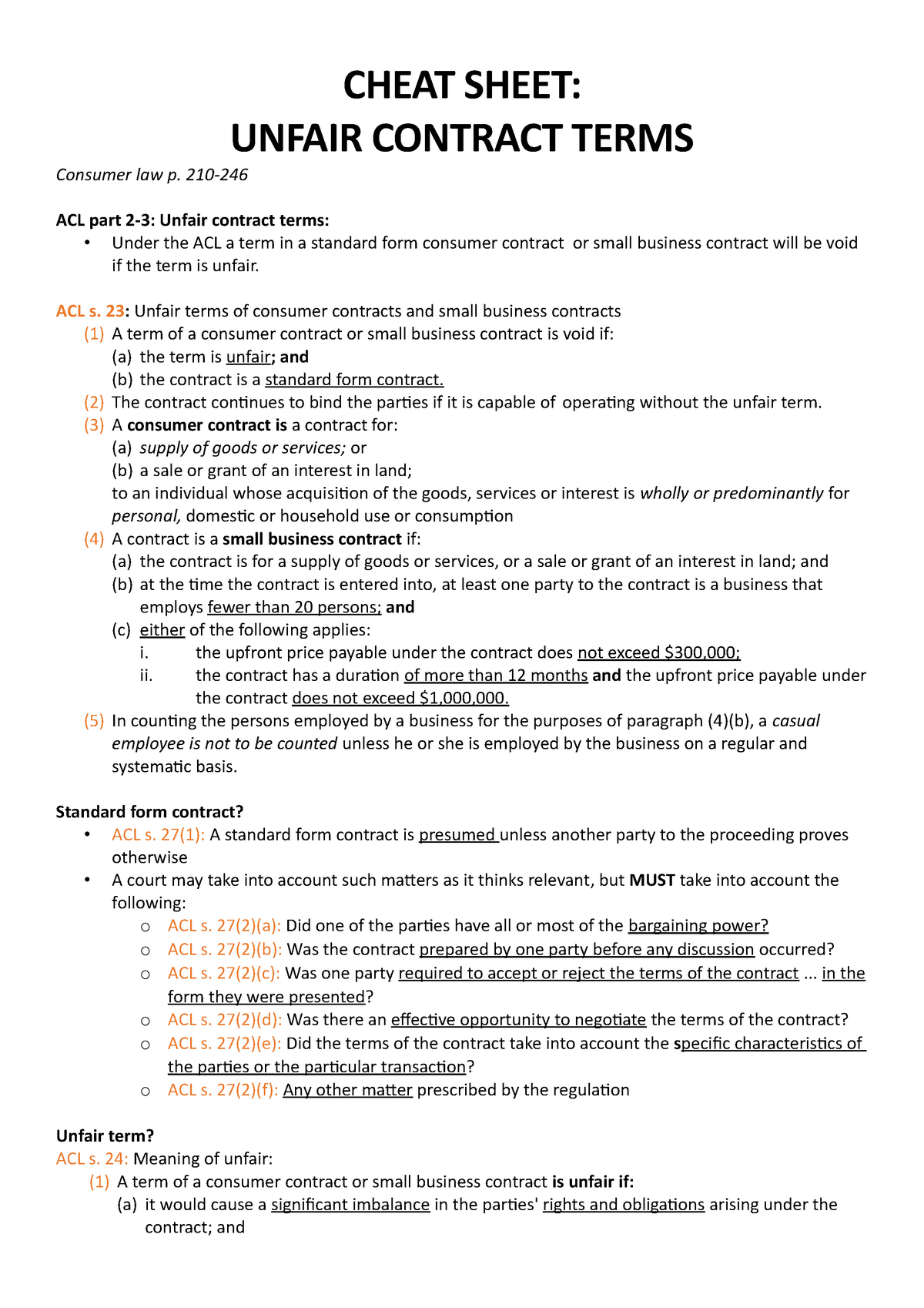

practitioners understand the unfair contract terms of the ACL. It covers what an unfair contract term is and which contracts are affected by the law. While the guide includes examples of the types of terms that may be considered unfair, it does not present a definitive list of what is unfair—or, by omission, fair—under the law. Ultimately,

New Unfair Contract Laws Explained Oceanic Marine Risks

A term in a consumer contract is unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties' rights and obligations under the contract, to the detriment of the consumer. 23. Transparency is also fundamental to fairness.

Beware of unfair contract terms LexisNexis® Australia

An unfair contract term is a term that disadvantages a party to a large extent. The rules on unfair contract terms vary depending on the nature of the contractual relationship. For instance, the rules may vary if the relationship is between a business and a consumer or between a business and a business. A term can be unfair if: the term is made.

Beware of unfair contract terms LexisNexis® Australia

Unfair terms. A standard form contract can put the power with one party. Therefore, an unfair term is something which strengthens that party's position. Generally, unfair terms exist where: The contract enables one party (but not another) to avoid or limit their obligations. A term allows one party to terminate the contract (but not the other)

Unfair contract terms and small businesses Examples and practical considerations

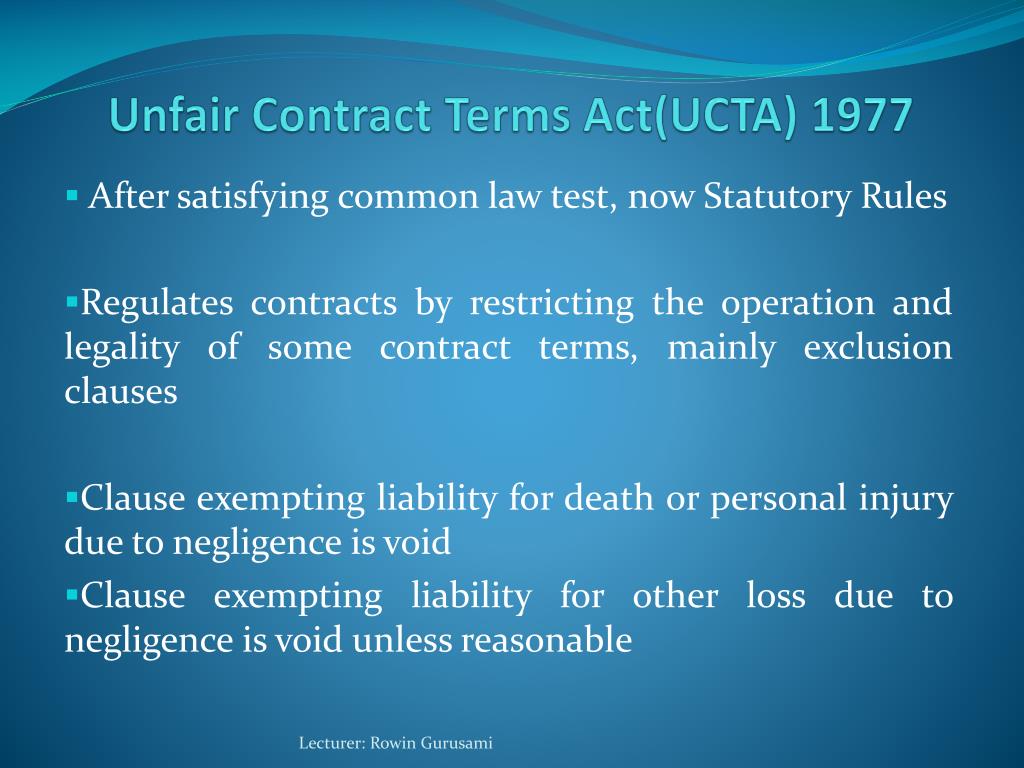

Unfair terms in English contract law are regulated under three major pieces of legislation, compliance with which is enforced by the Office of Fair Trading. The Unfair Contract Terms Act 1977 is the first main Act, which covers some contracts that have exclusion and limitation clauses. For example, it will not extend to cover contracts which.

Cheat Sheet Unfair Contract Terms CHEAT SHEET UNFAIR CONTRACT TERMS Consumer law p. 210246

Instead, it is the unfair term that loses its effectiveness, while the rest of the contract remains valid. However, if the contract cannot function without the unfair term, it may become.

9 Unfair Contract Terms YouTube

Unfair contract terms fall into two broad categories - those in the 'black list' and those in the 'grey list'. A blacklisted term is always unfair. Examples include excluding liability for death caused by your negligence or terms seeking to restrict statutory rights. A greylisted term has the potential to be unfair, depending on the.

(PDF) Unfair contract terms in B2C contracts

What is an Unconscionable Contract? An unconscionable contract is a contract that is so severely one-sided and unfair to one of the parties that it is deemed unenforceable under the law. Unconscionability in contract law means that the contract is one that leaves one of the parties with no real, meaningful choice, typically due to significant differences in bargaining power between the parties.

Unfair Contract Terms Will your business be caught by changes to the regime? White & Case LLP

Details. The Consumer Rights Act 2015 updates the law on the use of unfair contract terms in consumer contracts. This guidance for businesses will help you to understand what makes terms and.

PPT UNFAIR TERMS IN CONSUMER CONTRACTS PowerPoint Presentation, free download ID3429052

An unfair contract term is an unfair exclusion clause. An exclusion clause tries to exclude one company from being liable to another in a specific situation. One example would include a clause trying to limit the compensation payable to your business from another company if they breach the written agreement. Where an exclusion clause is unfair.

New unfair contract terms legislation passed Lexology

Either way, your case will be that the term of the contract is unfair and shouldn't be enforced against you. 3. Go to court. If the amount involved is below the small claims limit (£10,000 in England and Wales or £3,000 in Scotland and Northern Ireland), the case may be dealt with in the small claims court.

LawExchange.co.uk Powerpoint

The unfair contract terms regime in the Australian Consmer Law applies to consumer contracts and small business contracts that are a standard form contract. In Australia's laws related to contracts, there is no exact definition of a standard form contract. However, certain factors must be taken into consideration.