Company Limited By Guarantee Company limited by guarantee is also termed as guarantee company

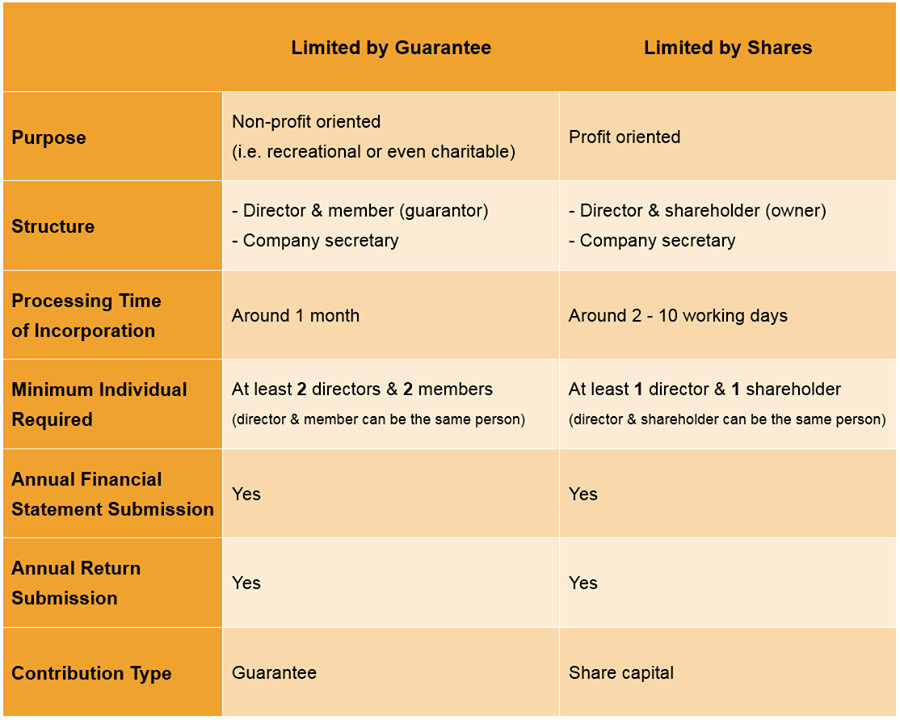

In a company limited by guarantee, there are no shareholders, but the company must have one or more members. Subject to any special provisions in the company's articles, the members will be entitled to attend general meetings and vote. In most companies, they can appoint and remove the directors and have ultimate control over the company.

Companies Limited by Guarantee Key Points to the Company Limited

A limited by guarantee company is one that has no shared capital. Instead, the members of the company agree to contribute a set amount of money in the event that the company is wound up. This is particularly useful for non-profit organisations as it protects the members from being liable for more than they have agreed to contribute.

Limited by Guarantee Companies YouTube

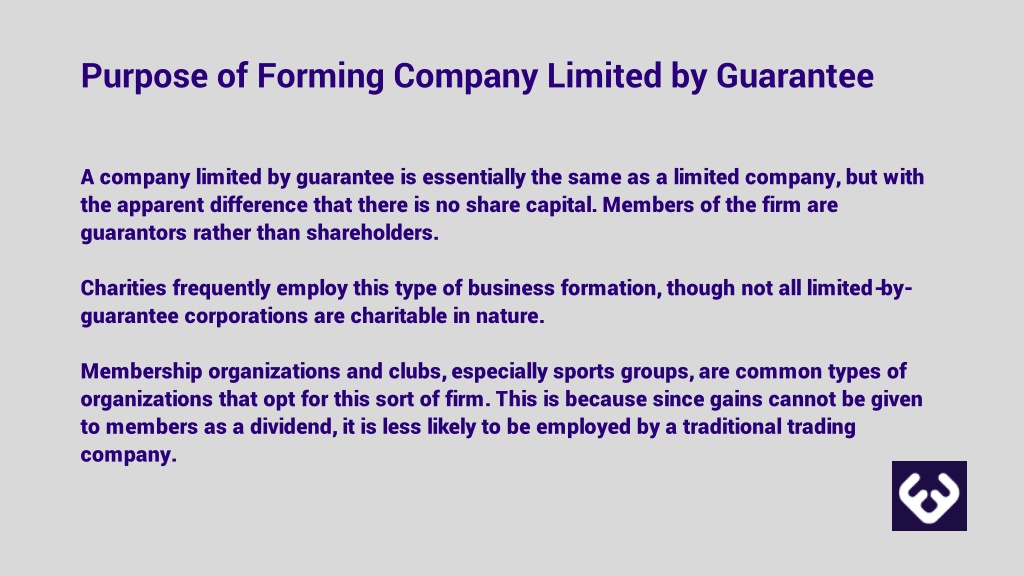

A company limited by guarantee is typically established for charitable causes or non-profit purposes. Any profit earned is reinvested and leveraged for advocating its non-profit activities. Entity limited by guarantee may affix the term' limited" in its name. This word garners a sense of trust among investors and clients.

Limited by shares vs. limited by guarantee

A company limited by Guarantee is often referred to as a 'not for profit' or 'Charitable company', this refers to the fact the parties involved do not remove the profit from the company as shareholders can in a company limited by shares. Any profit made by the company is re-used for the good of the business. A company limited by.

PPT Companies Limited by Guarantee A Clear Guide PowerPoint Presentation ID10860159

A company limited by guarantee is an alternative form of a company. It stands in contrast to the far more common company limited by shares. The distinction relates to how the law treats the company's owners when it comes to the company's liabilities, including financial debts.

What is a Company Limited by Guarantee? YouTube

A company limited by guarantee is a type of corporation used primarily for nonprofit organizations that require legal personality. It is an alternative type of corporation to the more usual 'share capital' corporation. The members or guarantors give up a certain sum or investments at the time of incorporation of such companies or later on.

Company Limited by Guarantee under Companies Act 2013

A company limited by guarantee (CLG) is a type of corporation where the company has no share capital (although rare exceptions exist). Members instead act as guarantors of the company's liabilities: each member undertakes to contribute an amount specified in the articles (typically very small) in the event of insolvency or of the winding up of the company.

Incorporated Trustees Companies Limited by Guarantee 1st Fiduciary

A company limited by guarantee is a distinct legal entity from its owners and is responsible for its own debts. The personal finances of the company's guarantors are protected. They will only be responsible for paying company debts up to the amount of their guarantees. 'Limited' status builds trust and confidence amongst clients and investors.

Companies limited by guarantee Pro Taxman

The main difference with a limited by guarantee company is that any profits they make are invested back into the company, rather than paid to investors. This kind of limited company is normally used for social enterprises like non-profits and charities. Instead of shareholders, these limited companies are funded by guarantors.

PPT Companies Limited by Guarantee A Clear Guide PowerPoint Presentation ID10860159

The term 'company limited by guarantee' refers to a specialised entity formed by a non-profit organisation and designed to limit financial liability.. The Australian government makes a distinction between small companies limited by guarantee, medium-sized companies with an annual revenue of less than $1 million, and larger companies with a.

Difference Between Company Limited by Guarantee and Company Limited by Shares YouTube

A company limited by guarantee refers to a type of company structure that is often used by non-profit and charitable organisations. The structure provides the organisation with the benefits of operating like a company in terms of legal status and protections but without the need for shares or owners. In place of shareholders, member-guarantors.

Community Blogs for HK Startups, SMEs and Entrepreneurs Bridges HK

The company benefits from employing people interested in contributing to its cause. Every member believes in the company's mission, values, and philosophy. People with a personal interest in the company limited by guarantee usually have a better understanding of its corporate structures and processes.

What is a Private Company Limited by Guarantee? (LTD) YouTube

The guarantee determines voting power in these companies. Benefits of Company limited by guarantee. A company limited by a guarantee is a distinct legal entity from its owner or guarantor. As a result, the company is personally liable for its debts. Guarantors are not personally held in chargeable for any of the company's debts.

Companies Limited by Guarantee Get the details right AccountingWEB

Companies limited by guarantee is one aspect of financial reporting that causes more confusion than it should when, in reality, it is fairly straightforward. A company limited by guarantee is just a limited company, but with the obvious difference to the usual company entity of there being no share capital. The company's members are.

Advantages & Disadvantages of a private Limited Company CruseBurke

Instead, the company has guarantors - also called members. They agree, upon becoming members, to guarantee a fixed amount towards the company's debts in the event of liquidation. This guarantee is usually £1. Without shareholders, a company limited by guarantee is not really 'owned', but the members still ultimately control it.

What is a Company Limited by Guarantee? Accotax

Guarantee Company: A form of corporation designed to protect members from liability, but which typically does not distribute profits to its members and does not divide assets into shares. Members.

- Red Queen Juan Gomez Jurado

- Sri Lankan Airlines Check In Online

- West Lakes Westfield Opening Hours

- Real Picture Of Guru Nanak Dev Ji

- St Charbel Prayer For Healing

- Bridges Of Kyoto Fame Crossword Clue

- Anzac Day Things To Do

- How To Get Prescribed Modafinil

- How To Drink A Pornstar Martini

- International Year Of Older Persons Coin Worth