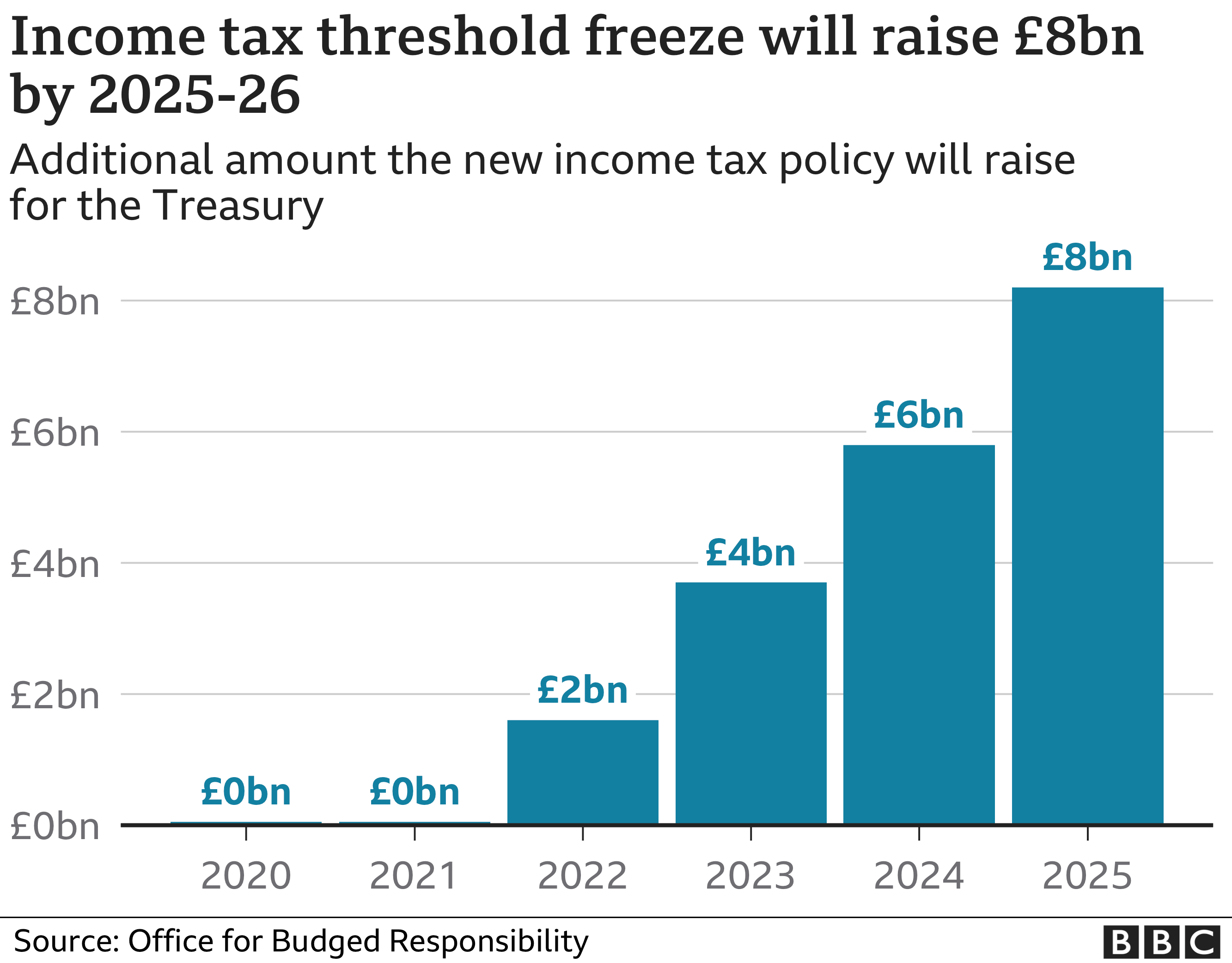

Budget 2021 Million more set to pay tax by 2026 BBC News

The debt reactivation falls within the same financial year as the removal of the low and middle-income earner tax offset (LITMO), which has also caused extremely lower tax returns for Australians. The scheme ran from 2019 and 2022 and gave Australians earning up to $126,000 a tax-time boon of up to $1500. How to check for reactivated debts

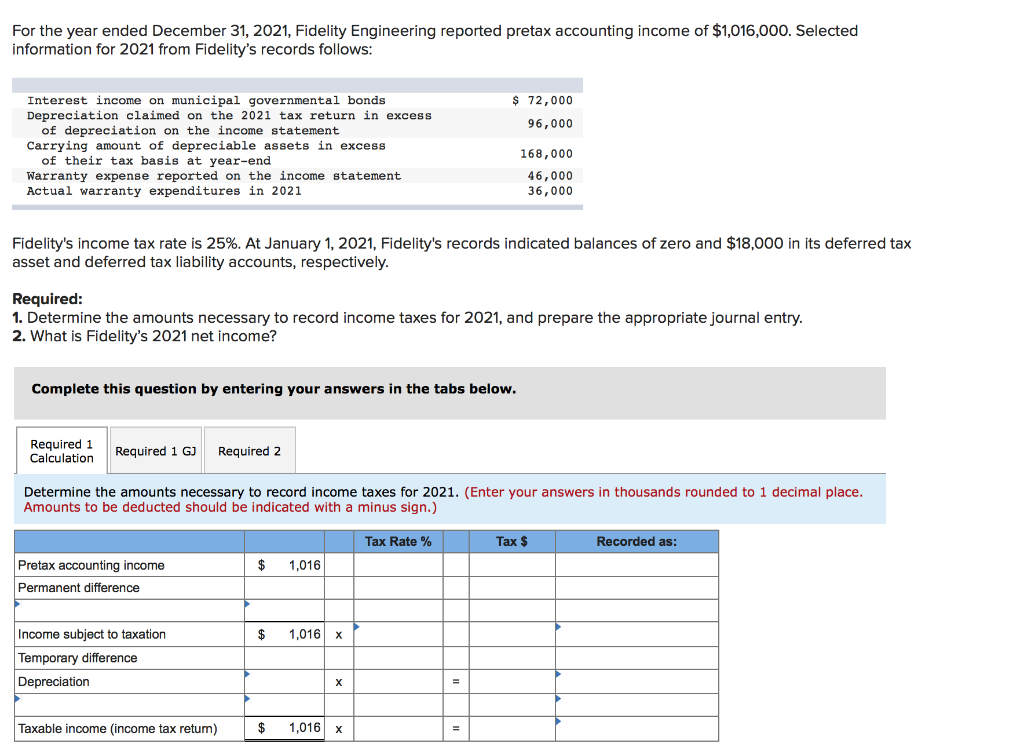

Solved For the year ended December 31, 2021, Fidelity

Hello i have a debt that has been cleared under Non-pursuit - uneconomical to pursue I was wondering if anyone knows what the triggers are that will re raise this. I want to get my affairs up to date without possibly triggering this.. Lodging your 2022 tax return. Footer navigation. We appreciate your feedback to help our community grow.

A proposed five to eight percent tax increase in Cramahe TownshipConsider This

The ATO has recently updated its Law Administration Practice Statement on debt relief, waivers, and non-pursuit of debt. Specifically, the Practice Statement provides guidance on the Commissioner's discretion to not pursue the recovery of tax debts, and ATO's ability to release individual taxpayers from their obligation to pay certain tax-related liabilities.

2023 Tax Bracket Changes PBO Advisory Group

Resumption of ATO debt collection of aged tax debts. Taxpayers with aged debts that the ATO had paused collecting or put on hold should be aware that offsetting aged debts against tax refunds or credits has now resumed. Letters were sent out in May 2022 to remind taxpayers that they have aged debts and that June 2022 will see the recommencement.

[Solved] Zekany Corporation would have had identical before taxes on... Course Hero

re-raise of non-pursuit; partial re-raise of non-pursuit; cancellation of non-pursuit. What to do if your debt is reactivated. When we tell you your debt has been reactivated, you need to pay the outstanding amount in full by the due date advised. If you cannot pay by this date, you may be able to set up a payment plan to pay by instalments.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC and more Wiztax

Find out more about how to lodge and pay your tax using ATO online services: Lodge your tax return online with myTax. Check the progress and status of your return. Amend your income tax return. Lodge a non-lodgment advice. Lodge, pay, vary or manage your PAYG instalments online. Lodge your claim for a refund of franking credits.

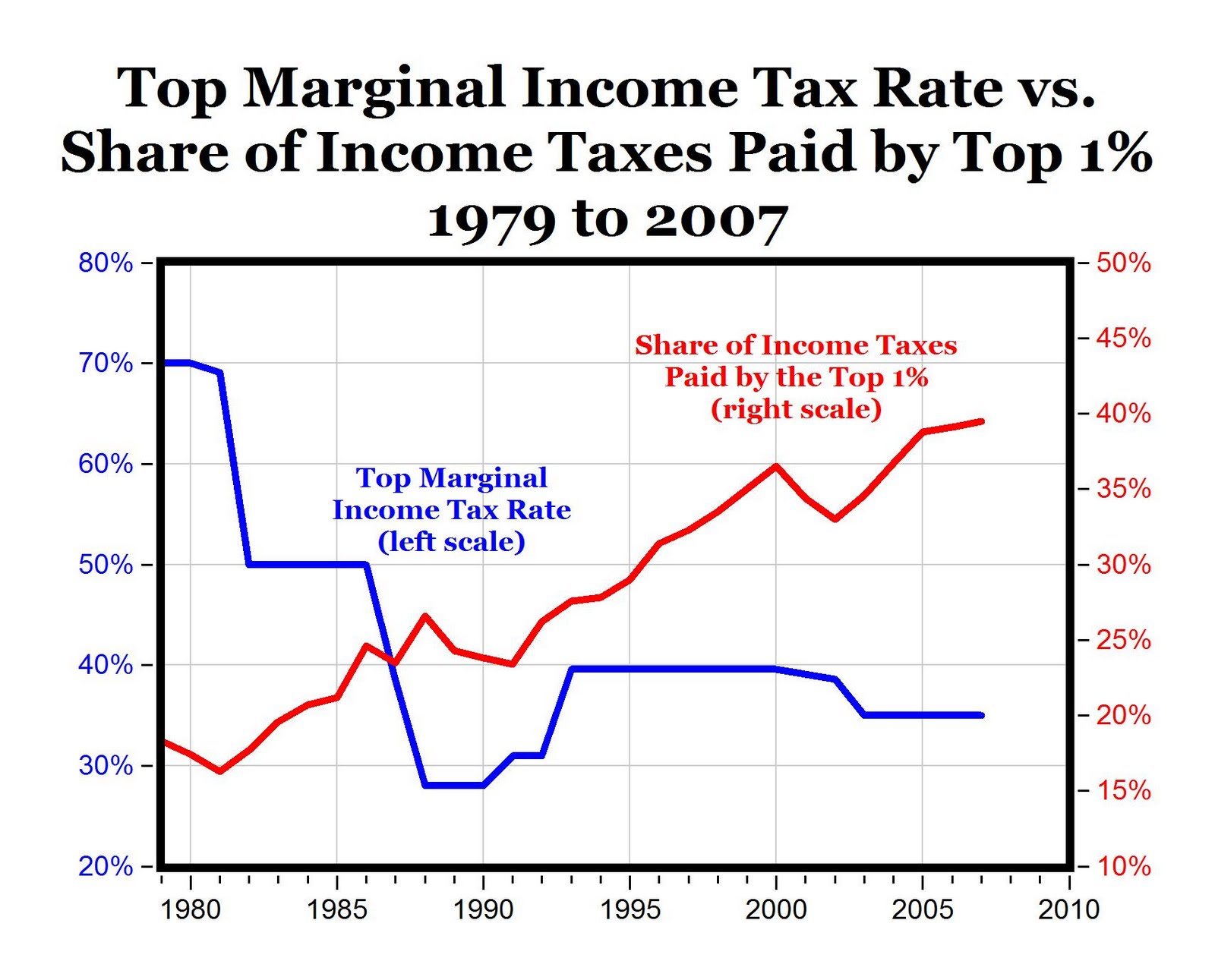

CARPE DIEM Tax Rates and Share of Tax Revenues from Top 1

What is a non-pursued debt?The ATO may decide that it is uneconomical to pursue a debt owed to it. This means the ATO has placed the pursuit of that debt on an indefinite hold rather than try to recover it at that time.Circumstances where this might occur include: • the taxpayer owes a debt to the ATO but does not have enough income or assets from which the ATO could seek to recover the debt.

The Complete List of Tax Credits for Individuals Tax credits, Federal tax, tax

The ATO may re-raise some or all of a tax debt it previously placed on hold when new information becomes available that suggests recovery of the debt is now possible.. "partial re-raise of non-pursuit" and "cancellation of non-pursuit" - the net amount of the debit/s minus the credit/s is the remaining balance of the debt on hold.

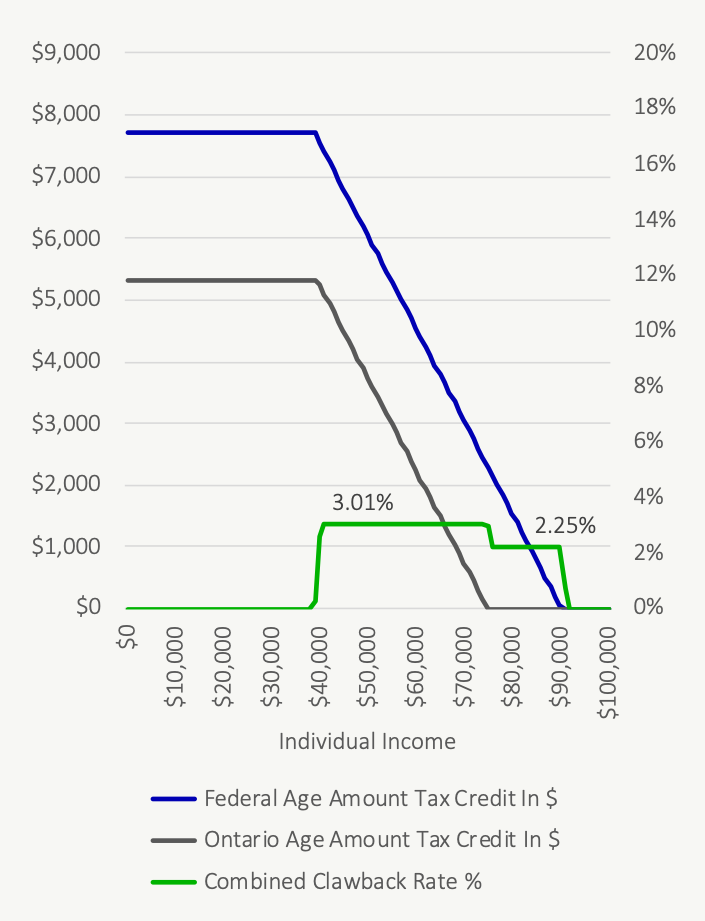

The Age Amount Tax Credit May Increase Your Marginal Tax Rate Graph PlanEasy PlanEasy

63(1) of the FMAA concerning non-pursuable debts. 26.2.4 The authority not to pursue recovery of a debt is delegated by the Commissioner to Tax officers occupying specified positions. Copies of the Commissioner's delegations have been provided to all Branch Offices. Officers who approve the non-pursuit of any amount must ensure

What Is Taxable (2023)

Most helpful reply. Hello @S.fitzgerald. This occurs if we decided that it wasn't viable to pursue the debt based on your circumstances and income. The debt isn't gone forever though. We can re-raise all or part of the debt if we believe you're in a position to pay.

PPT Revenues and Expenditures PowerPoint Presentation, free download ID1631006

Applying all three tests - income/outgoings, assets/liabilities, and other relevant factors - will enable the ATO to decide whether serious hardship exists and to what extent. It may be the case that hardship exists, but it is not serious enough to warrant a full release of a tax debt. In this case, a partial release may be applied.

Great Tips to help you score more marks in Direct and Indirect Taxation BMS Bachelor of

The ATO has recently announced that it will resume collecting aged debts by offsetting tax refunds or credits. Aged debts are a collective term the ATO uses to refer to its uneconomical non-pursued debts that it has placed on hold and has not undertaken any recent action to collect. These debts do not typically show up.

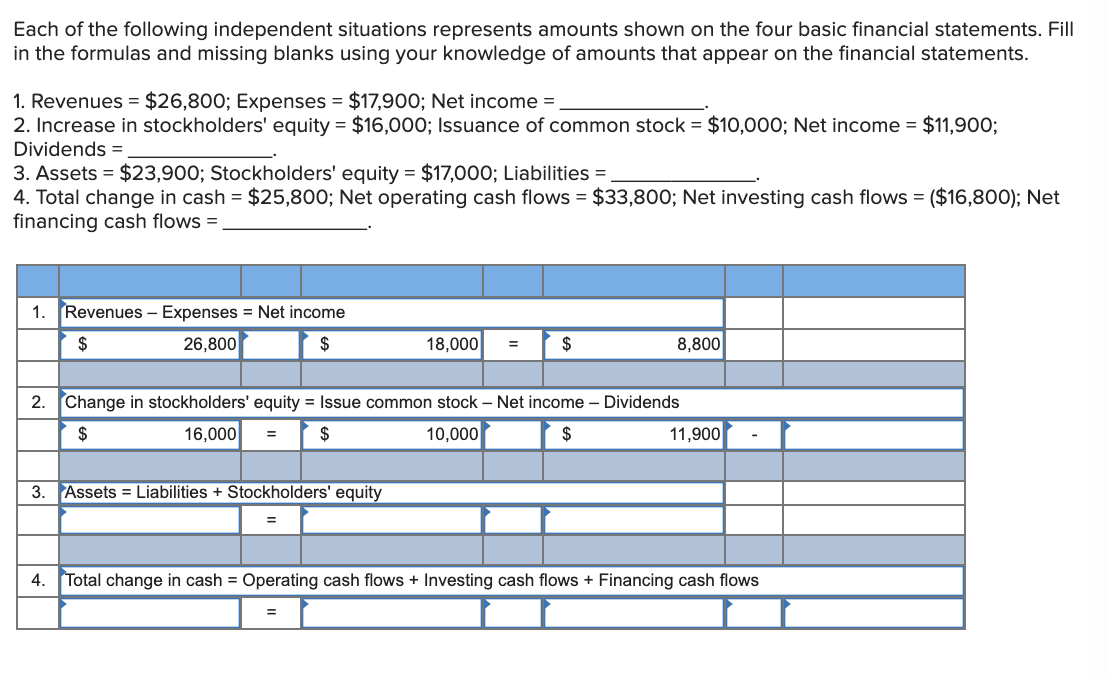

Solved Each of the following independent situations

The ATO may describe certain debt transactions in tax accounts as 'non-pursuit'. These amounts are referred to as 'non-pursued debts'. What is a non-pursued debt?Where the ATO determines not to pursue a debt on the basis that it is 'uneconomical' to do so, this means it is a debt the ATO have placed on an indefinite hold. This is referred to as a non-pursued debt (debt).A debt may.

Do we really need to raise taxes that soon? Unscrambled.sg

The ATO advised that the main mechanism by which debts are re-raised is where a taxpayer subsequently lodges an income tax return that results in a credit of over $500. When this occurs the written-off debt indicator activates a re-raise 'exception' which must be followed before the tax return can be finalised. 2.16.

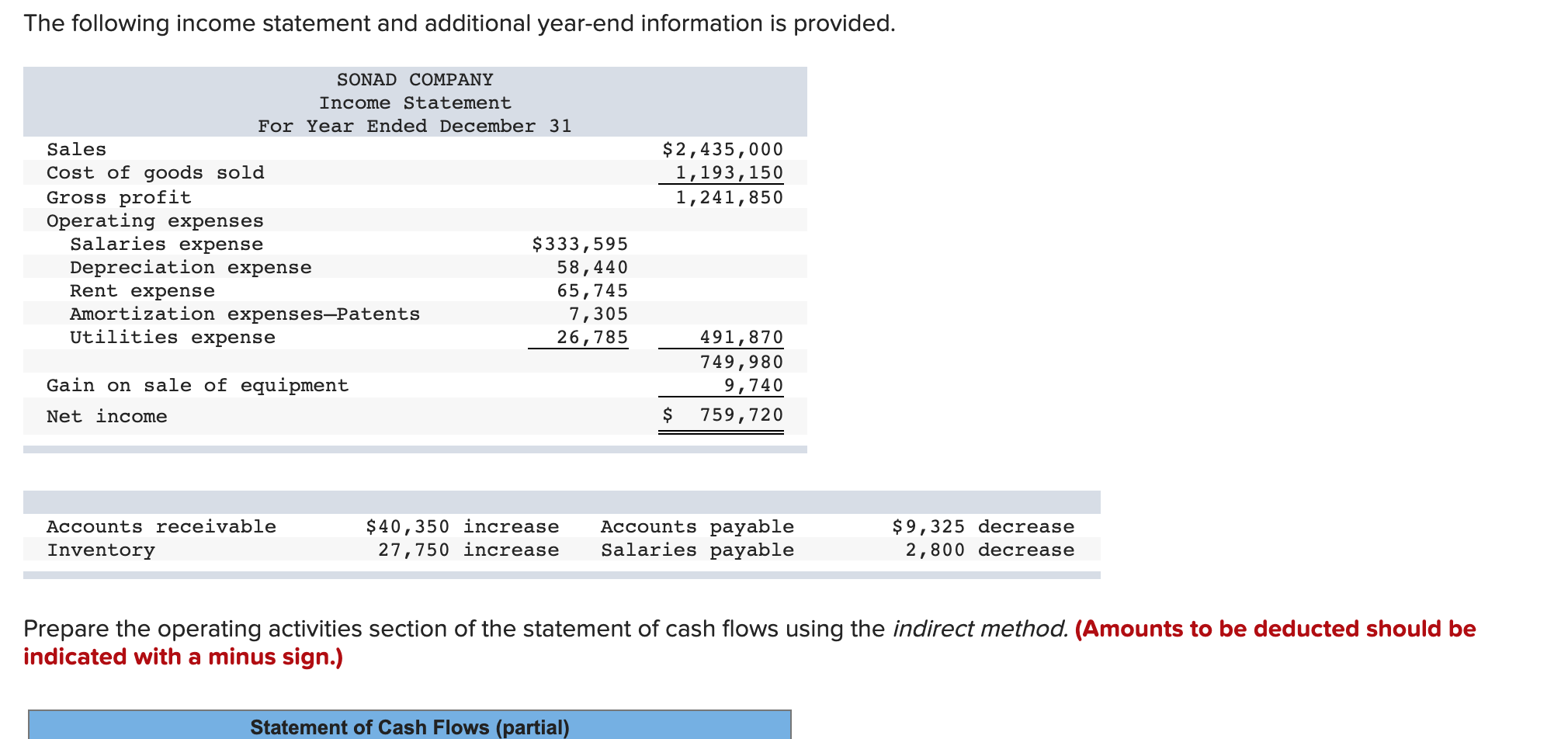

Solved The following statement and additional

Most helpful reply. AdamH (Master) 19 July 2023. "Partial re-raise of a non-pursuit amount - Income Tax" means that you previously had a debt and the ATO decided it wasnt worth chasing you for it at the time. But now that you have a refund, the ATO is still owed that money, so they took it first.

Calculation Of Deferred Tax Assets And Liabilities With Example Tax Walls

10. Some factors that should be taken into account by a delegate considering non-pursuit of amounts of revenue under this heading are: (i) the amount of revenue involved (ii) the length of time the amount has been outstanding, the steps taken to recover the debt to date and the costs to the Tax Office involved in those steps

- Mum And Dad Tattoo Designs

- The Untethered Soul Michael Singer

- Dan Murphy S Deception Bay Products

- What Does A Politician Do

- Practising The Presence Of God Book

- Neon Genesis Evangelion Shinji Ikari Raising Project

- Yard Garage Sales Near Me

- Aston Martin Db 12 Volante

- Houses For Sale Second Valley

- Port Douglas Buy Swap Sell