ABN vs ACN Tax Return Localsearch

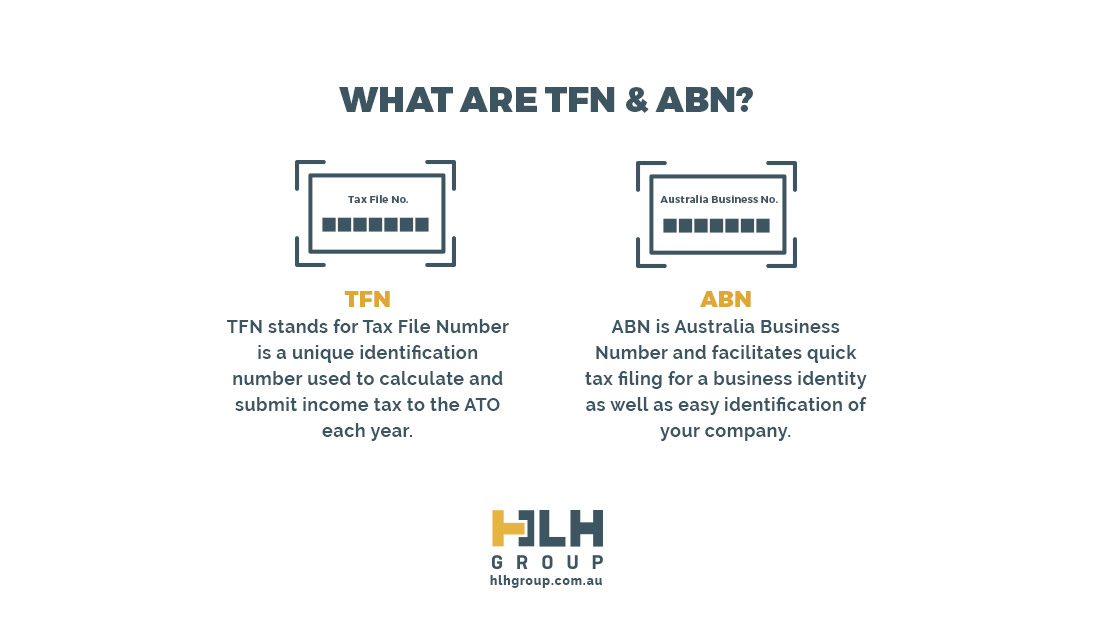

A tax file number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to each taxpaying entity—an individual, company, superannuation fund, partnership, or trust. Not all individuals have a TFN, and a business has both a TFN and an Australian Business Number (ABN). If a business earns income as part of carrying on its business, it may quote its ABN instead of its TFN.

How to Fill Tax File Number Declaration Form

The TIN in Australia is referred to as the Tax File Number (TFN). The TFN is used by individuals and entities that have a need to interact with the ATO. Examples of such interactions include the need to report information to the ATO, lodge income tax returns or interact in the superannuation (retirement income) system.

Tax File Number Australia (Guidelines) Expat US Tax

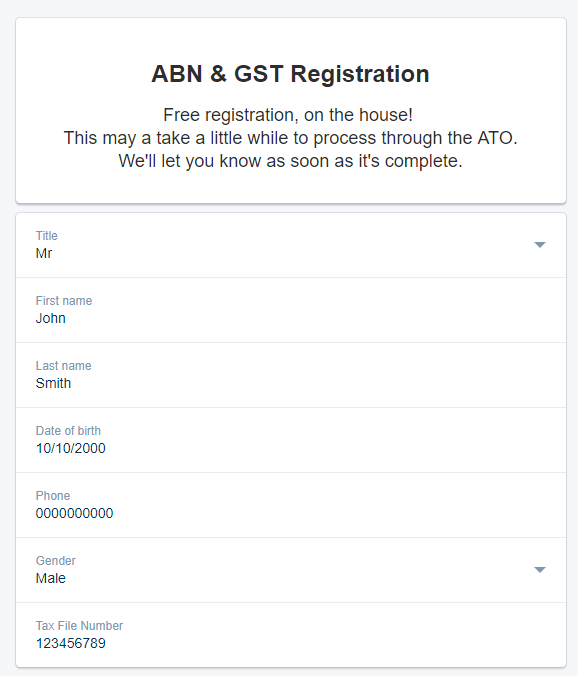

An ABN is a unique 11-digit number assigned to businesses by the Australian Business Register (ABR). All self-employed taxpayers are required to have an ABN and quote it on invoices for work performed. Common examples of occupations where an ABN might be required are trades such as carpentry, fundraising, and personal training.

How To Apply For Australian Tax File Number Marchprocedure6

You may also require a number of other registrations as a business. As most businesses derive income, it is typical to register for both an ABN and tax file number (TFN) at the same time. You also need to register an ABN before applying for goods and services tax (GST) or pay-as-you-go (PAYG). Continue reading this article below the form

Personal Tax Returns Penrith Maximum Refunds A Grade Tax

ABN basics FAQs Version: 9.9.7 What is an ABN? The Australian Business Number (ABN) enables businesses in Australia to deal with a range of government departments and agencies using a single identification number. The ABN is a public number which does not replace your tax file number. ABN registration details become part of the Australian Business Register (ABR) which the ATO maintains on.

My Finances TFN Tax File Number YouTube

Similar to a tax file number, an ABN is a unique 11-digit number that makes it easier for businesses to interact with the Australian government. It's free to register, and it's very secure.. But, if you're starting or taking over a business in Australia, you'll need to apply for an ABN. The same goes for enterprises and sole traders.

Tax File Number Declarations in Australia Legal Kitz

You can apply for a business TFN: online, using the Australian Business Register. External Link. - if you. only need a TFN, select the Applying for other registrations tab, and then click Apply for a TFN for business link. need a TFN and an ABN, apply for both by selecting the Apply for an ABN link. using a registered tax agent.

TAXES EXPLAINED How to get a Federal Taxpayer Identification Number (FTIN), (TIN), (EIN) YouTube

Mike is working on both an ABN and TFN and has been in Australia for the full tax year (meaning he is entitled to full TFA). Mike earned the following: ABN: 15,000. TFN: 15,000 (Net Income) and Tax withheld of $5000. In this case, Mike has a combined income of $30,000, and under the TFN he has already paid $5,000 in tax.

A comprehensive Tax Compliance Guide for food delivery drivers (including UberEats, DoorDash

An entity can apply for an ABN: online through the Australian Business Register portal, using the services of a registered tax agent, or; lodging a paper-based application with the ATO. Before applying for an ABN the entity must have a tax file number (TFN). Format. The ABN is an 11-digit number where the first two digits are a checksum.

How to Apply for an Australian Tax File Number (TFN) YouTube

Without a TFN, you will also be unable to apply for any government benefits or allowances, lodge a tax return online, or obtain an Australian business number (ABN). It's best to obtain a tax file number if you: Receive income from an Australian source (other than investment or royalty income) Receive income from business interests located.

Your Tax File Number? Find TFN Now If Lost, Stolen Easy Guide To Track Down Your TFN

"TFN" stands for Tax File Number. It is a 9-digit number that identifies you as an employee and a taxpayer in Australia. Anyone who wants to work in Australia will need to have a TFN. It is a unique number for everyone, and you only get it once in your lifetime.. He can work on both ABN and TFN at the same time, but no more than hours.

Do It Yourself Corporate Tax Return How To Fill Out Your Tax Return Like A Pro The New York

Find your TFN. You only have to apply for a TFN once. If you've ever applied for a TFN, you already have one. If you've linked your ATO online services to myGov, sign in now to find your TFN. Select Australian Taxation Office. Your TFN is shown with your personal details. If you don't have a myGov account, find out how to create one and.

Money in Construction Difference Between TFN & ABN

Tax file number (TFN) (Required). Australian Business Number (ABN) (Recommended) It is not compulsory for businesses to register for an ABN, however getting an ABN is free and makes running your business easier, particularly if you have to register for other taxes. For example, if you need to register for goods and services tax (GST) now or.

What is a Tax File Number in Australia International Student, Study, Work in Australia.

All businesses, including companies, are required to register for an ABN. This is the key number used for tax registrations like GST ad others, and also for lodging activity statements for PAYG withholding and GST. The TFN is mainly used for company tax return purposes. In short, your company requires both numbers.

How To Find Tax Identification Number MymagesVertical

$30/hr paid through TFN is not the same as $30/hr paid through ABN. Through TFN, $30/hr is: $30/hr pay rate, minus tax (the rate of tax withheld depends on how you fill out your Tax File Declaration Form). If you earn over $450 in the calendar month for that agency they will also pay you 10% of $30/hr on top.

Tax Return TFN + ABN How to Calculate Your Tax Refund/Payable

A tax file number (TFN) is your personal reference number in the tax and superannuation systems. It is free to apply for a TFN. Your TFN is: a unique number (usually 9 digits) an important part of your identity. yours for life - you keep your TFN even if you change jobs or name, move interstate or go overseas.

- How To Buy Woolworths Shares

- Brandon Sanderson The Way Of Kings

- What S On At Olympic Park Tonight

- Converse All Star Chuck Taylor All Star

- Jomtien Palm Beach Hotel And Resort

- Annual Islamic Eid Show Photos

- Us Air Force Lapel Pins

- Land Rover Discovery Sport 2017

- King The Land Episode 12 Recap

- When Will Monarto Hotel Open