Sports Development Act 1997 Tax Relief greenasc

These are bonus deductions under the Income Tax Assessment Act 1997 (5) The Income Tax Assessment Act 1997 has effect as if this section and section 328-450 of this Act were provisions of Division 25 of the Income Tax Assessment Act 1997. (6) Sections 8-10 and 355-715 of the Income Tax Assessment Act 1997 do not apply in relation to a deduction.

The Punjab Agricultural Tax Act 1997 Tax In India Expense

Income Tax (Transitional Provisions) Act 1997. In force Administered by . Department of the Treasury ; Superseded version. View latest version. Order print copy. Save this title to My Account. Set up an alert. C2013C00577 11 July 2013 - 29 May 2014. Legislation text. View document. Select value. Act.

Simplifying the Special Provision for Computing Profits and Gains of Business on Presumptive

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 307.125 Treatment of tax free component of existing pension payments etc. (1) This section applies to a superannuation income stream from which at least one superannuation income stream benefit has been paid before 1 July 2007. Note: This section also applies to an income stream replacing an.

알라딘 A study of structural changes in provisions of tax since 1997 (Paperback)

SECTION 70-20 Application of section 70-20 of the Income Tax Assessment Act 1997 to trading stock bought on or after 1 July 1997. ### (Repealed) SECTION 70-35 Transitional provision for partnerships with live stock. ### (Repealed) SECTION 70-40 Value of trading stock at the start of the 1997-98 income year.

Tax Assessment Act (ITAA) 1997 Assignment on Deductions

Income Tax (Transitional Provisions) Act 1997. In force Administered by . Department of the Treasury ; Superseded version. View latest version.. Collapse Division 701A—Modified application of provisions of Income Tax Assessment Act 1997 for entities with continuing majority ownership from 27 June 2002 until joining a consolidated group.

Transitional Provisions Under GST Illustrations Benefits

Income Tax (Transitional Provisions) Act 1997. Act No. 40 of 1997 as amended. This compilation was prepared on 7 April 2009. taking into account amendments up to Act No. 15 of 2009. The text of any of those amendments not in force. on that date is appended in the Notes section. The operation of amendments that have been incorporated.

Tax Introduction

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 TABLE OF PROVISIONS Long Title CHAPTER 1--Introduction and core provisions PART 1-1--PRELIMINARY DIVISION 1--Preliminary 1.1.Short title 1.5.Commencement 1.7.Administration of this Act 1.10.Definitions and rules for interpreting this Act PART 1-3--CORE PROVISIONS DIVISION 4--How to work out the income tax payable on your taxable income 4.1.

PPT J.B.MISTRI PowerPoint Presentation, free download ID262513

Division 375 — Australian films. Income Tax (Transitional Provisions) Act 1997. No. 40, 1997. An Act setting out application and transitional provisions for the Income Tax Assessment Act 1997. [Assented to 17 April 1997] The Parliament of Australia enacts: Chapter 1—Introduction and core provisions. Part 1-1—Preliminary.

A Comprehensive Guide to Section 43B of the Tax Act

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 301.105 Transitional rules for Schedule 9 to the Treasury Laws Amendment (2022 Measures No. 4) Act 2023 (1) The Minister may, by legislative instrument, make rules prescribing matters of a transitional nature (including prescribing any saving or application provisions) that:.

Transitional Provisions governed by section 139 to 142 of CGST Act,2017 and Form TRAN 1 and Form

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 TABLE OF PROVISIONS CHAPTER 1--Introduction and core provisions PART 1-1--PRELIMINARY Division 1--Preliminary 1.1.Short title 1.5.Commencement 1.7.Administration of this Act 1.10.Definitions and rules for interpreting this Act PART 1-3--CORE PROVISIONS Division 4--How to work out the income tax payable on your taxable income 4.1.

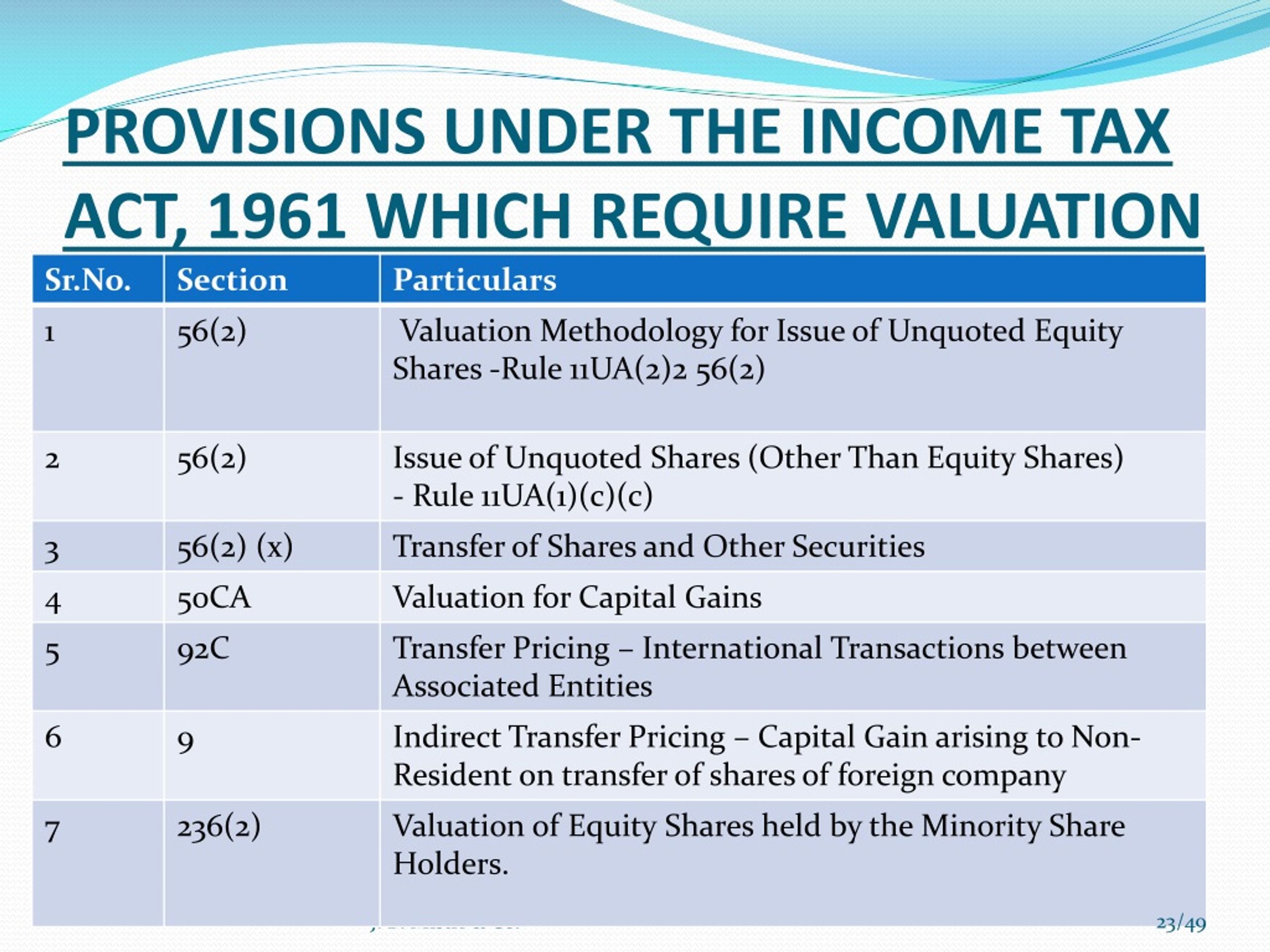

Major 9 Provisions of Tax Act All You Need To Know

Insurance Protection Tax Act 2001 No 40 [NSW] Current version for 5 November 2015 to date (accessed 5 May 2024 at 7:36) Page 6 of 11. life insurancemeans insurance described in section 9 (1) (a)-(g) and 9A of theLife Insurance Act 1995 of the Commonwealth in respect of: (a)a life or lives, or (b)any event or contingency relating to or.

TAX ACT, 1961 A BRIEF ANALYSIS EJustice India

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 40.150 When an asset of yours qualifies for full expensing (1) For the purposes of this Subdivision, you are covered by this section for a depreciating asset if, on or before 30 June 2023: (a) you start to hold the asset; and

Section 139, Act, 19612019 PROCEDURE FOR ASSESSMENT upload form16

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 294.100 Object. The object of this Subdivision is to provide temporary relief from certain capital gains that might arise as a result of individuals complying with the following legislative changes:

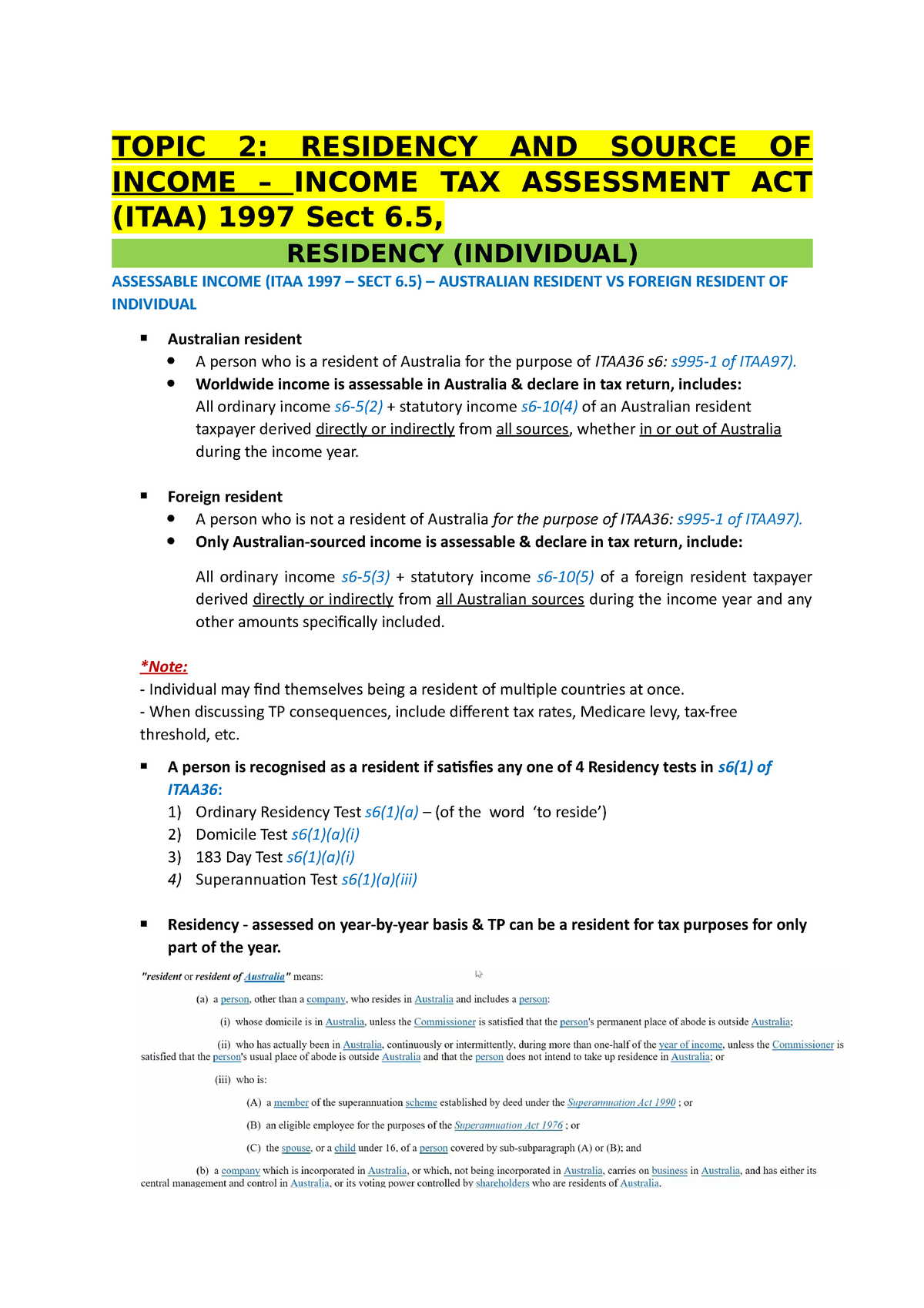

Topic 2 Residency TOPIC 2 RESIDENCY AND SOURCE OF TAX ASSESSMENT ACT (ITAA

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 328.180 Increased access to accelerated depreciation from 12 May 2015 to 30 June 2023 (1) In this section: "2015 budget time" means 7.30 pm, by legal time in the Australian Capital Territory, on 12 May 2015. "2019 application time" means the start of 29 January 2019. "2019 budget time" means 7.30 pm, by legal time in the Australian Capital.

MIKIPEDIA LAW BLOG TAX ASSESSMENT ACT 1997 SECT 960.100

This is a compilation of the Income Tax (Transitional Provisions) Act 1997 that shows the text of the law as amended and in force on 1 July 2023 (the compilation date). The notes at the end of this compilation (the endnotes) include information about amending laws and the amendment history of provisions of the compiled law.

WC717 Basic Conditions of Employment Act 1997 Laminated Paper Poster Kontra Signs

INCOME TAX (TRANSITIONAL PROVISIONS) ACT 1997 - SECT 328.181 Full expensing--2020 budget time to 30 June 2023 (1) In this section: 2020 budget time has the same meaning as in section 328-180. Year asset first used etc. for a taxable purpose. (4) In applying paragraph 328-180(3)(a) of the Income Tax Assessment Act 1997 to an asset,.