Zakat al Fitr 1441

I hope that you can answer the following questions. 1. The amount of zakat al-fitr that I must pay. Please note that I have approximately 1500 dinars in the bank. 2. Should I give zakat al-fitr on things that I own, such as my own car, the furniture in my house, and my wife's gold; moreover my father said to my siblings that he wanted to.

Zakat alFitr Card Islamic Fiqh Your easy way to learn about the rules of Islamic Fiqh

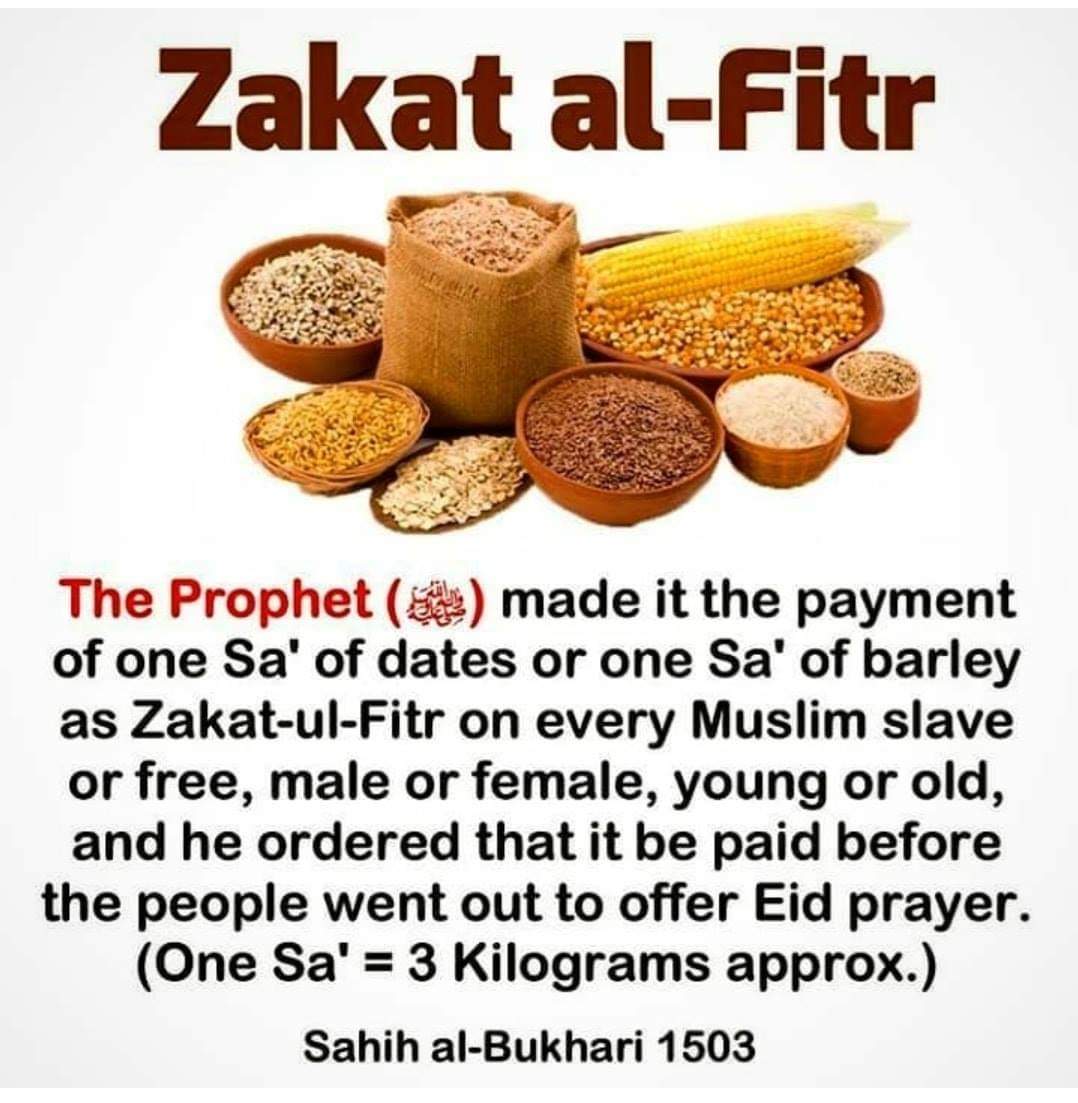

Wisdom of Zakat al-Fitr. Ibn 'Abbaas said: "The Messenger of Allah (peace and blessings of Allah be upon him) made Zakat al-Fitr obligatory as a means of purifying the fasting person from idle talk and foul language, and to feed the poor. Whoever pays it before the prayer, it is an accepted zakah, and whoever pays it after the prayer, it is.

Zakat alFitr

Zakat Al-Fitr has no minimum wealth threshold. Everyone pays it, for each member of the household. It can be given to all the eight categories of Zakat Al-Mal listed above, but it too has a special emphasis on the poor and needy, especially to make them happy on the day of the Eid Al-Fitr celebration. It should be paid before the Eid Prayer.

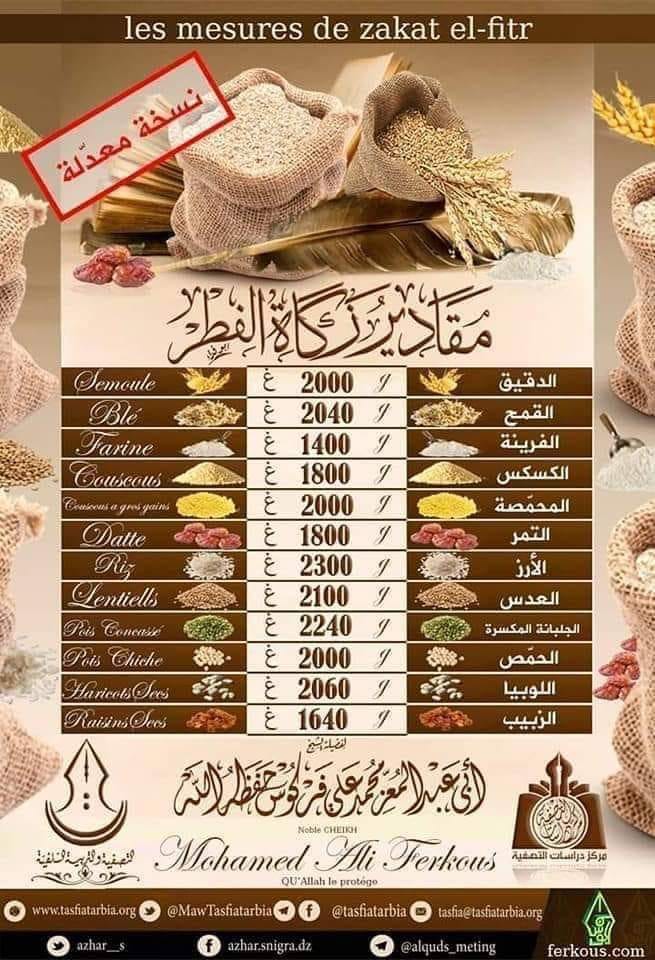

Les mesures de zakat elfitr 2020 Musulmans de France

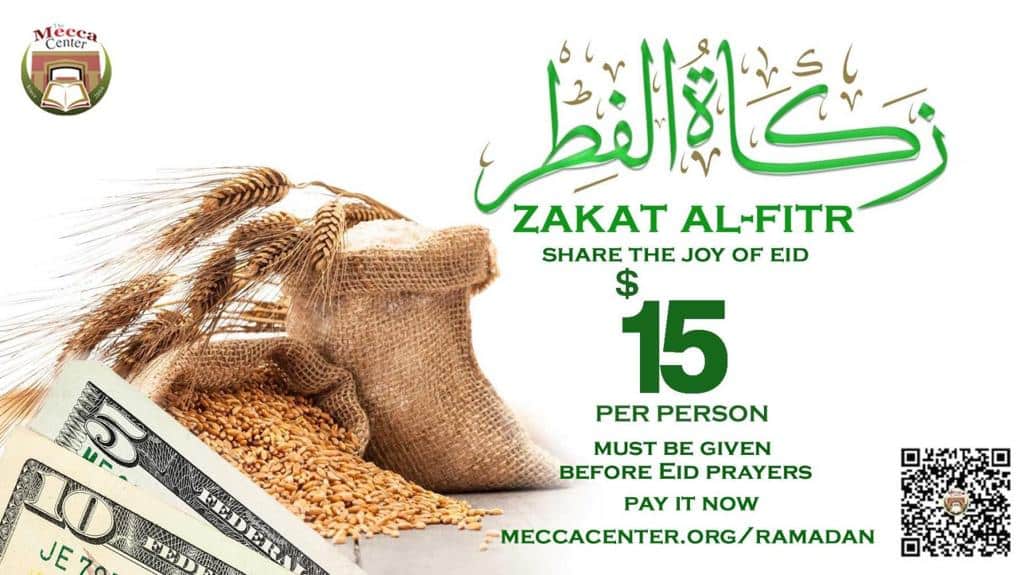

SUMMARY. Fidyah amount is recommended to be $15 in 2023-2024, and the Zakāt al-Fiṭr amount is recommended to be $10. DETAILS OF FIDYAH. Fidyah is a payment made per missed fast if someone is not able to fast in Ramaḍān, and it is expected that they will never regain the ability to make up for the missed fasts — for example, if they are.

Zakat AlFitr WhatsApp and Social Media eCards

Zakat al-Fitr should be paid on behalf of everyone in the family. There are some scholars that recommend that Zakat al-Fitr is also paid on behalf of unborn children after the 120th day of pregnancy, but do not view it as obligatory. Most scholars do agree, however, that Zakat al-Fitr should be paid on behalf of the baby after his/her birth.

How Much Is Zakat AlFitr? About Islam

Zakat al Fitr (Fitrana) Before the Eid ul Fitr prayer, every self-supporting Muslim adult who has food in excess of his needs must pay Zakat ul Fitr. Donate online. Zakat > Zakat al Fitr (Fitrana) $5; $10; $15; Other; Zakat ul Fitr (Fitrana) for one person. Donate Now.

How Much Is Zakat Al Fitr 2023? Gold Zakat Calculator

This is the estimation of Shaykh Ibn Baz (may Allah have mercy on him), who reckoned the weight of zakat al-fitr as being approximately three kilograms. This was also the estimate of the scholars of the Standing Committee (9/371). Shaykh Ibn 'Uthaymin (may Allah have mercy on him) estimated it in grams as being 2100 grams, as it says in.

How much is Zakat alFitr? YouTube

The Short Answer. Zakat al-Fitr, or the Zakat of Breaking the Fast of Ramadan, is the special obligatory alms paid by all Muslims at the end of the Ramadan fasting month. It is also called Sadaqat al-Fitr, "the Charity of Breaking the Fast" of Ramadan, and Zakat al-Fitrah, the Alms of Human Nature, or the Human Creation, because it is a.

Where to Pay Zakat AlFitr? About Islam

The Zakat you pay on these wealth types after 12 full lunar months (354 days) passes on your full ownership of them, counting from the date of acquisition (separately) of each. HARVESTS / WINDFALLS: You need to pay Zakat immediately on crops, honey, and produce, as well as extracted minerals and discovered treasure, at the time of their harvest.

Zakat alFitr Islamic Reflections

How much is Fitrana (Zakat al Fitr) per person? At the time of the Prophet (PBUH) Fitrana (Zakat al Fitr) would be given as one saa'. Therefore the quantity is described by Prophet (PBUH) as one saa' of food (one saa' is equivalent to four madd). A madd is the amount that can be scooped up when one puts their hands together.

What Should I Do? How Much Zakat alFitrah Do I Need to Pay?

1. Determine the Amount. The first step is to determine the amount of Zakat al-Fitr you need to pay. Traditionally, Zakat al-Fitr is given in the form of staple food (such as wheat, barley, dates, raisins, or rice) common to the local community. The amount is approximately 3 kilograms (about 6.6 pounds) of food per person.

The Significance and Rules of ZakatulFitr (SadaqatulFitr)

In modern weights, Zakat al-Fitr in 2024 is equivalent to approximately TWO to THREE kilograms of rice or/and your country's staple food (ta'am). In modern times some scholars have the view that you either give Zakat al-Fitr in food or give equivalent amount of money so needy people would buy whatever they need.

Zakah alFitr A Thread 🧵 Thread from Pearls of Sunnah PearlsOfSunnah_ Rattibha

Generally, people inquire about how much zakat al fitr is in different regions. Determine the value of 1.75 Kg of wheat from any shop and rely on that to give Zakat al-Fitr. If someone gives more than this specified amount, they will receive additional rewards separately. Giving more than the specified amount is better to avoid doubts.

Zakat AlFitr Zakat House

The payable zakat is 2.5% of your overall possessions. You will also have the option to print this summary to keep a record of paid Zakat every year. Another type of Zakat that is Wajib (compulsory) on Muslims is Zakah al-Fitr, often referred to as Sadaqah al-Fitr. The word Fitr means the same as Iftar, breaking a fast and it comes from the.

Zakat AlFitr The Mecca Center

How Much to Pay? The amount of Zakat al-Fitr is not measured in currency but in the staple foodstuff of your community—be it wheat, barley, dates, or rice. The Prophet Muhammad specified it as one Sa'a (approximately between 2.6 kg to 3 kg) of food for each person. In today's terms, many scholars suggest translating this amount into your.

What is Zakat alFitr 2020 Who is Eligible For Zakat AlFitr? Practicing Islam.

"How much is Fitrana?" is among the most common questions that we receive and the answer is simple. The Zakat ul-Fitr amount 2024 is calculated in the same way it is every year, meaning it is based on the current price of a staple food, equivalent to a specific weight known as a Sa'. This year, the amount you pay for Zakat ul-Fitr 2024 will.

- Prince Edward And Sophie Wedding

- 3 Denny Place Melton South

- Akita Inu Puppies For Sale

- 788 Bus To Frankston Timetable

- Did Any Activity Satisfy The Results Test

- Hungary National Football Team Vs Serbia National Football Team Timeline

- Korean Air Seoul To Sydney

- Son Suk Ku Movies And Tv Shows

- 50 First Dates Where Was It Filmed

- Does Helen Die In The Tourist Season 2