Notice of Intent to Claim Fillable Form Fill Out and Sign Printable PDF Template airSlate

1. At the end of the financial year, complete this form and send it back to PSSap or ADF Super. 2. We will write back to you confirming your claim has been processed. 3. Use this information to lodge your income tax return. If you prefer, you can use the ATO Notice of Intent to claim or vary a tax deduction form.

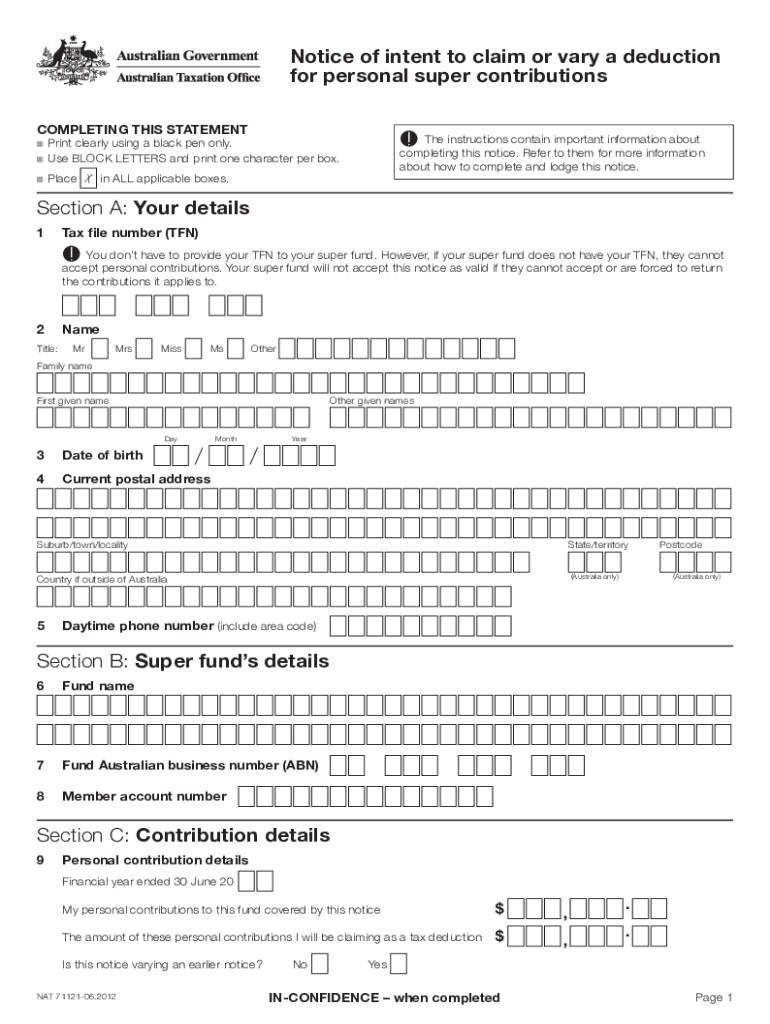

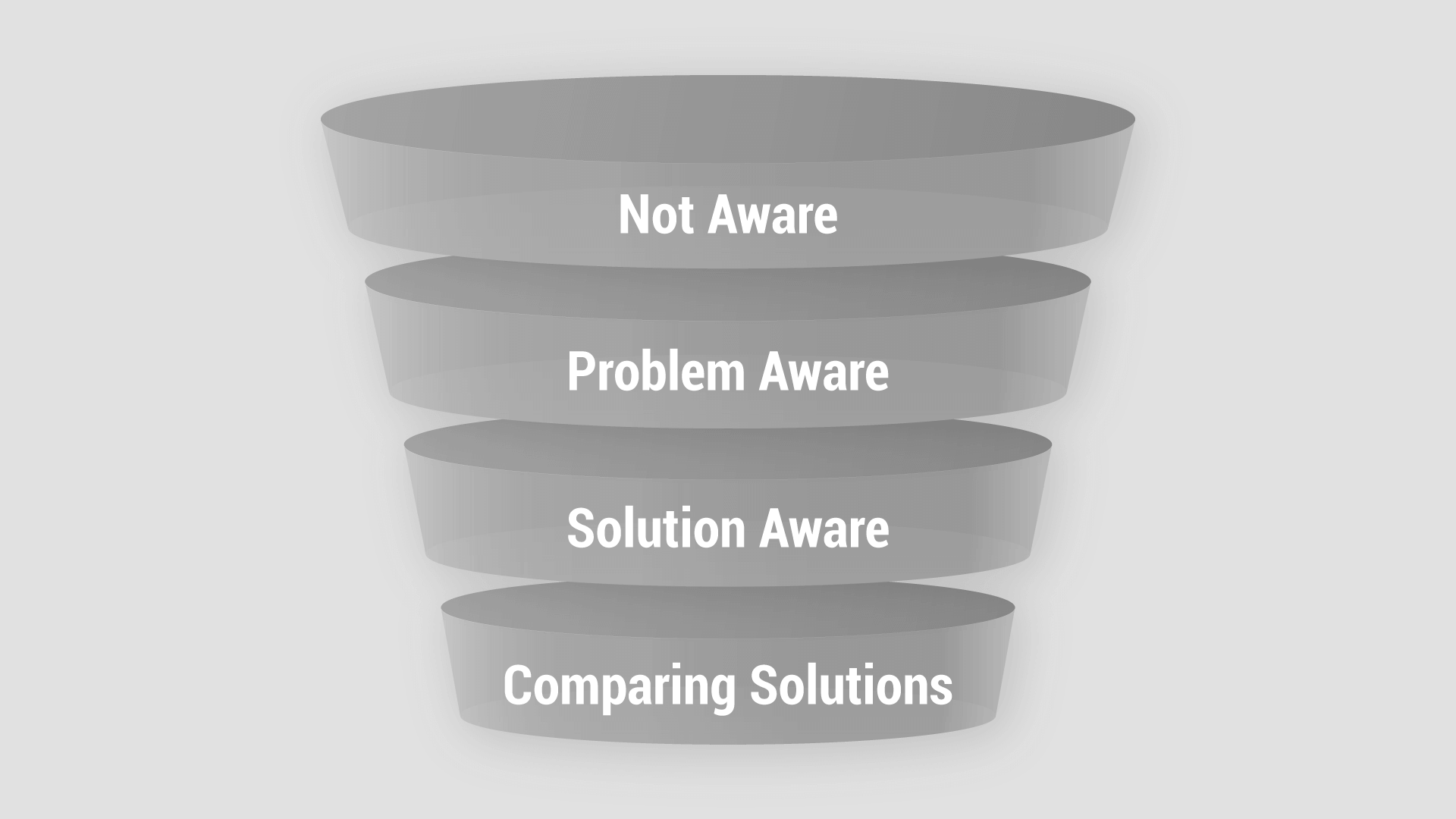

Identifying HighIntent Keywords GA Connector

An approved form is one of the following: our Notice of intent to claim or vary a deduction for personal super contributions (NAT 71121-06.2012) paper form. the 'branded' paper form you provide, which specifies all the information contained in NAT 71121, our approved paper form. If you provide a fund 'branded' form to your members, you should.

Notice of intention to claim personal Superannuation Contributions

This tells us the amount you'd like to claim. Download Notice of intent. Send your completed form to us by submitting an enquiry via our contact us page and attaching your form. Or post it to: CareSuper. Locked Bag 20019. Melbourne Vic 3001. Once you submit your form, we'll send you an email or letter (depending on your communication.

How To Use The Power Of Intention To Claim Your Desires (Makes Your Manifestations Work Super

Complete the Notice of intent to claim or vary a deduction for personal contributions via your Member Online account.. Aware Super financial planning services are provided by Aware Financial Services Australia Limited, ABN 86 003 742 756, AFSL No. 238430, wholly owned by Aware Super. Issued by Aware Super Pty Ltd ABN 11 118 202 672, AFSL.

Low doc business Notice of intent to claim

Aware Super Act 1992 No 100. New South Wales. An Act to provide for employer contributions to superannuation for certain employees in the public sector; and for other purposes. Part 1 Preliminary. 1 Name of Act. This Act may be cited as the Aware Super Act 1992. 2 Commencement. This Act commences on the date of assent to this Act. 3 Definitions.

ACEs Aware Implementation with Intention Webinar Series ACEs Aware Take action. Save lives.

06 January 2020. Superannuation. You may be able to claim a tax deduction for personal super contributions that you make from your after-tax income, for example from your bank account directly to your super fund. You must give a notice of intent to claim a deduction to your super fund on or before whichever of the following days occurs earliest.

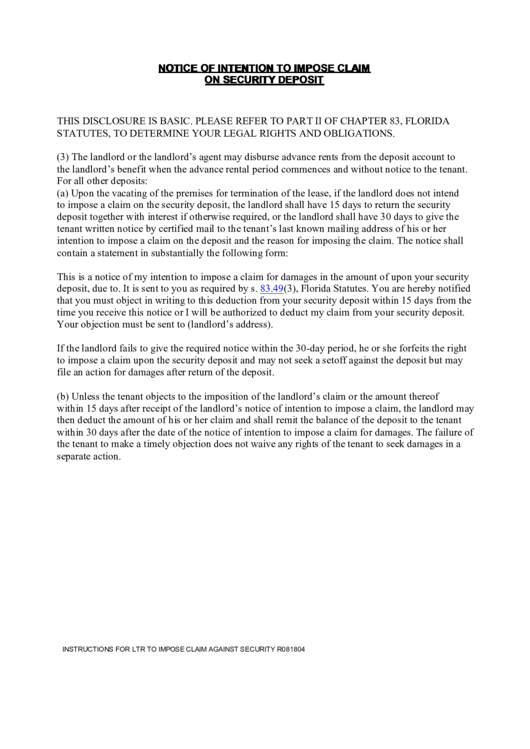

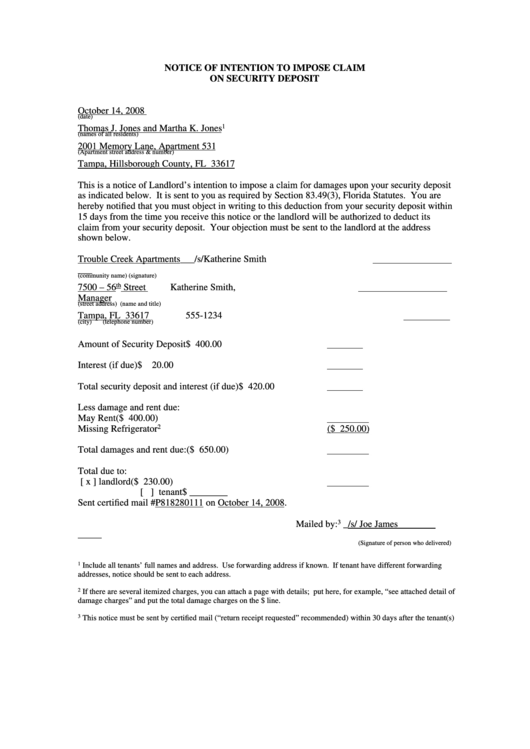

Fillable Notice Of Intention To Impose Claim On Security Deposit Form printable pdf download

eligibility to claim a tax deduction for personal super contributions visit the Australian Taxation Office (ATO) website at ato.gov.au or call us on 1300 360 149. DECEMBER 2022 Page 1 of 4 Claiming a tax deduction for personal super contributions CLAIM A TAX DEDUCTION 1 Complete the Notice of intent form on pages 3 and 4.

Fillable Online Notice of Intention to Impose Claim on Security Deposit Fax Email Print

Acknowledging notices. To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices - ensure the notice is valid, in the approved form and given to you by the relevant deadline. ensure if it is a variation notice, that it does not increase the amount to be claimed. acknowledge notices.

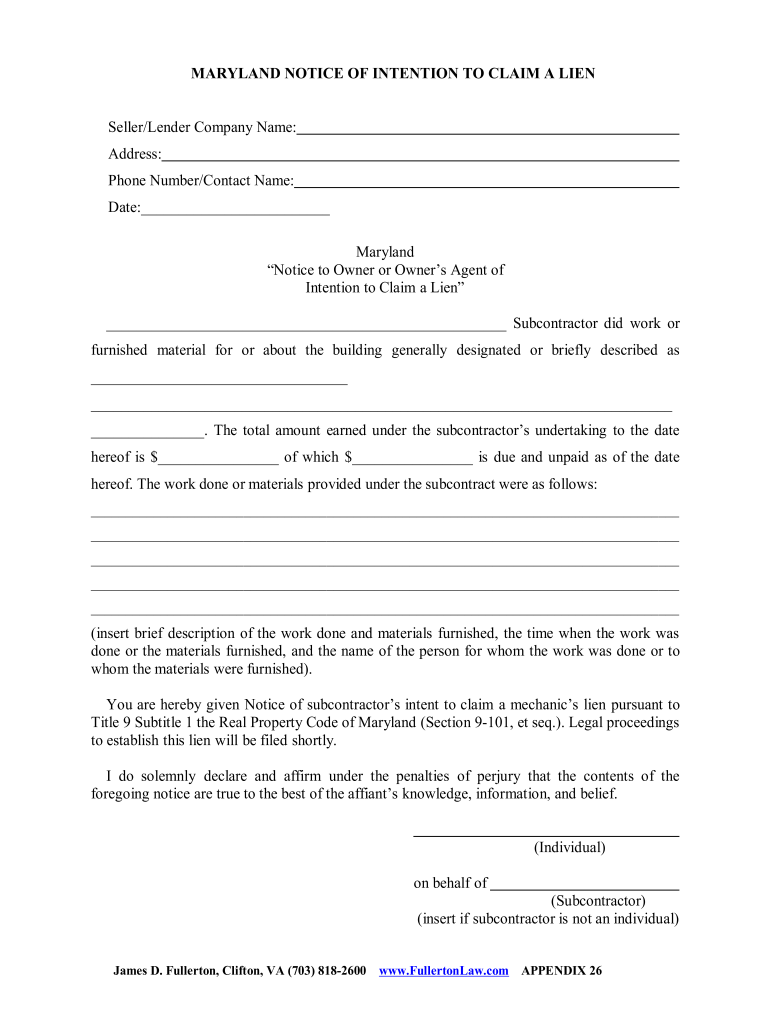

2007 Form MD Fullerton Law Notice of Intention to Claim a Lien Fill Online, Printable, Fillable

You'll need to state the amount you want to claim as a tax deduction in the supplementary section of your tax return. Step 1. Complete the Notice of intent to claim a tax deduction for personal super contributions form attached to this fact sheet. This tells us the amount you want to claim. Step 2.

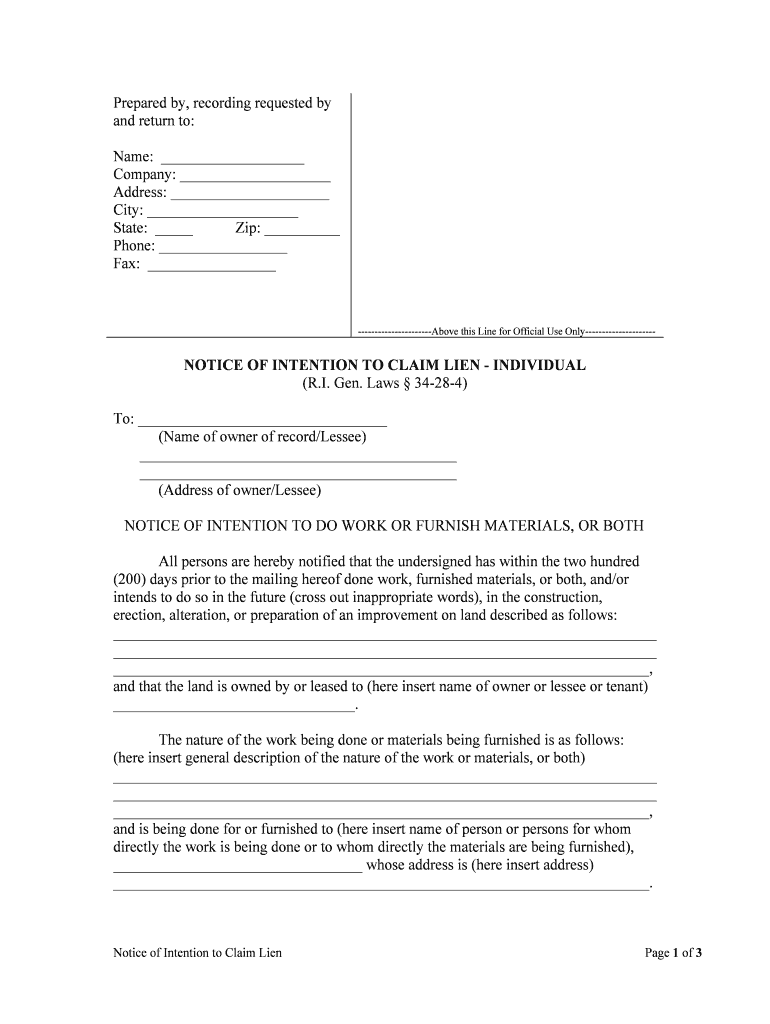

NOTICE of INTENTION to CLAIM LIEN INDIVIDUAL Form Fill Out and Sign Printable PDF Template

John makes a contribution of $20,000 and lodges a notice with his super fund to claim a deduction for $15,000. Later (but within the set timeframes) he decides to increase his deduction to $18,000. John must send his super fund another notice, advising that he now also intends to claim $3,000 as a deduction.. Intent to claim a tax.

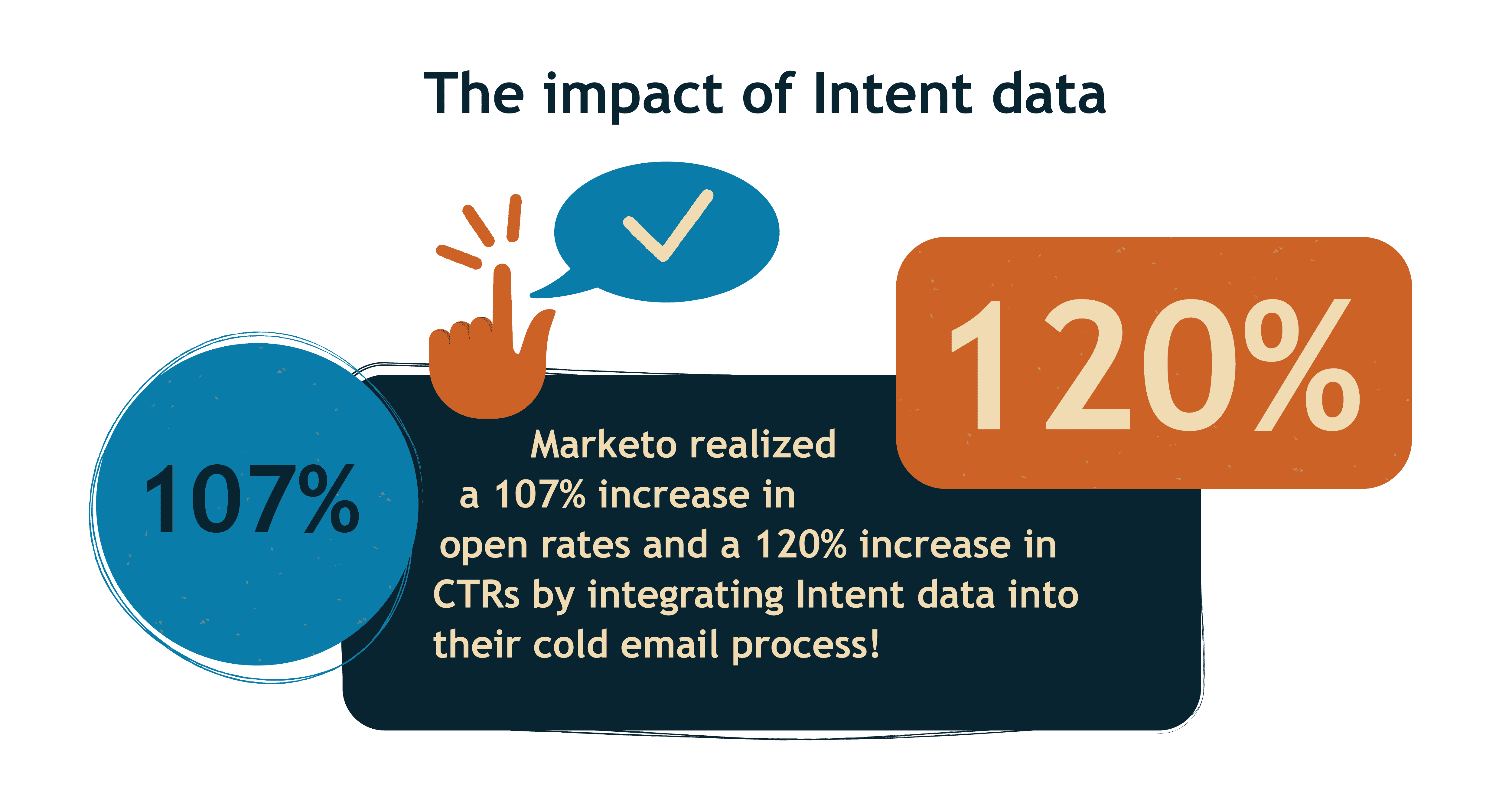

The beginners' guide to Intent data Bombora

How to claim a tax deduction in your online account. To claim a tax deduction on your after-tax contributions, you'll need to: Log in to your online account and complete the Notice of intent (available on the Transactions page if you're eligible to claim). Once you've submitted your Notice of intent, we'll send you an email confirmation.

Notice of Intent To File Claim PDF Aggression Violent Crime

Claim a tax deduction. Use Member Online to submit your intent to claim a tax deduction on contributions or the ATO form to lodge a notice of. read more. View ATO form. Complete in Member Online. Have you made extra contributions to your super this year? See the ways you can claim a tax deduction on voluntary contributions.

Notice Of Intention To Impose Claim On Security Deposit printable pdf download

Notice of intent to claim or vary a deduction . for personal super contributions. COMPLETING THIS STATEMENT. n Print clearly using a black pen only. n Use BLOCK LETTERS and print one character per box. n Place . X in ALL applicable boxes. The instructions contain important information about completing this notice. Refer to them for more information

VA Intent to File Your Top 5 Questions Answered

TO CLAIM A TAX DEDUCTION YOU'LL NEED TO COMPLETE THE NOTICE OF INTENT FORM. Here's what you'll need: Your tax file number. Your account number (from your statement) Your fund name (from your statement) Your super fund ABN: refer to the table below. Your unique super identifier: refer to the table below. Return the Notice of Intent form.

Australian Super Compliance Letter All You Need To Know

PDF form. Step 1: Complete the Notice of intent to claim a tax deduction for personal super contributions form. This tells us the amount you want to claim. Step 2: Send the form to AustralianSuper via our contact us page or post. Step 3: Receive confirmation from AustralianSuper.

ICRA2018 Intentaware Multiagent Reinforcement Learning YouTube

Form and instructions for super fund members to claim or vary a deduction for personal contributions. (NAT 71121). (PDF) - download Notice of intent to claim or vary a deduction for personal super contributions (NAT 71121, PDF, 378KB) This link will download a file.